Food, shelter and clothing -- the bare essentials of life.

However, in today's industrialized world the list doesn't end there.

In addition to the basics there are utilities, Internet, phone, TV, gas (for those of us who don’t own an electric car) and insurance, to name a few. These no longer feel like discretionary expenses.

Since most of us devote a fixed amount of our income to these monthly bills, it makes good sense to invest in companies that sell these services. By definition, their revenue stream should be fairly stable.

Take insurance companies, for example. While the phrase 'insurance' might induce some yawning, it is an essential component to modern life.

It certainly isn't the most glamorous industry. You might not want to pay for it, but you can't afford to not have it. And when catastrophe strikes you'll thank your lucky stars that you have insurance.

Society's dependency on insurance is undoubtedly good for insurance companies but also good for investors.

Just look at Warren Buffett's Berkshire Hathaway (NYSE: BRK.A). Its core business was originally textiles, but in 1967 it ventured into the insurance industry. Today, one share has a price tag of almost $200k with even more potential for continued growth.

Insurance companies have had a good run the past decade. However, recent disasters such as Hurricane Sandy and the Japan earthquake and tsunami have resulted in massive selloffs of shares. Insurance companies have begun charging higher premiums and stock prices have been ascending gradually. But many stocks remain undervalued.

One such company that I like is The Travelers Companies, Inc. (NYSE: TRV). It is a well-known brand in property and casualty (P&C) insurance, which protects the assets of individuals and businesses from certain events, such as an accident, hurricane or fraud.

Although P&C insurance is a competitive business, firms with strong brands, a broad product set, a diversified customer base and a conservative investment philosophy can not only survive but thrive. You can check off all four for TRV, which has a long history of providing commercial, specialty and consumer insurance products across the U.S. and abroad while maintaining steady profitability, both on an underwriting and investment basis.

When valuing capital intensive financial stocks like banks and insurers, instead of using my preferred metric, free cash flow, I take a slightly different approach and focus on return on equity (net income divided by shareholders’ equity).

As you may know, free cash flow excludes investment income and values all cash and investments at face value. This method is fine for most companies but inappropriate for a company like TRV, whose job is to generate a certain amount of return on its investment portfolio.

Like any other insurance company, TRV collects premiums from its customers and invests those proceeds until it’s time to pay out any claims to policyholders. Of its $26 billion in total revenue, roughly $3 billion is comprised of such investment income.

Hence, I like to use a residual income model when evaluating financial stocks. In this approach, the value of a company’s equity depends on the return that it is generating on its equity base (return on equity) relative to the cost of raising that equity (cost of equity).

If the return is higher than the cost, the stock should trade at a premium to its book value (a price / book multiple above 1.0X) and, if not, at a discount (a price / book multiple below 1.0X). For instance, if you raise $100 of capital at a cost of 10% and earn $12 on that capital (or 12% return on equity), you have just created $2 of positive economic value that will compound going forward and your “stock” should be worth about a 20% premium to your book value of $100, or $120.In the case of TRV, I estimate that its normalized earnings is roughly $3.4 billion, which translates into a return on equity (ROE) of 13.4%. It’s important to note that my estimate assumes no further growth / improvement in the company’s premiums, investment portfolio, yields or underwriting margins, which is quite conservative (just the way I like it).

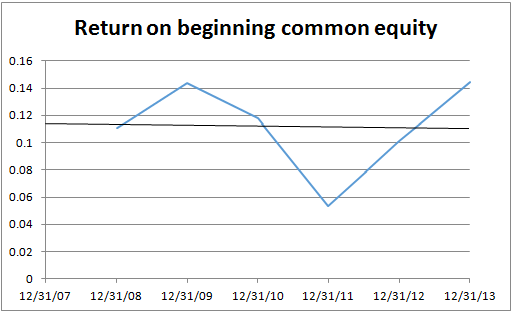

As shown in the table below, TRV’s ROE has hovered in the low-teens range over the past several years (with the exception of 2011, when Superstorm Sandy caused elevated losses across the industry) and was roughly 15% over the past 12 months, despite the low rate environment that has pressured investment income. This compares favorably to its peer group (which includes such well-known insurers as ACE, AIG, Allstate and Chubb), whose average ROE was 11%.

Given the 490 basis points of positive spread between TRV’s return on equity (13.4%) and cost of equity (8.5%), the stock is worth about 1.57X its book value of $73.06 per share, or $115. Relative to its current price of $95-96, this represents total return upside of 23%, including a 2.3% dividend yield.

Not too shabby for an insurance company with relatively stable underwriting margins, a conservative investment portfolio and a history of returning capital to shareholders via dividends and share repurchases (including $2.8 billion, or 8% of its market cap over the past 12 months).

In addition, TRV can be a good diversification tool for any portfolio because, like other P&C insurers, it tends to be less correlated with other equities.

Finally, it is a play on rising interest rates, which would enhance the investment income it generates from its largely fixed income portfolio.

Some investors may shy away from owning shares of insurers, because they view them as risky in light of recent disasters.

If you're a conservative investor like me, be assured that insurance companies hate risk just as much (if not more) than you do. Although the business seems risky because of unpredictable natural disasters, it is in fact more predictable than you think.

When you hire a number of experienced statisticians and actuarial scientists whose sole jobs are to predict the long term, you lessen your risk dramatically. Companies can calculate in advance how much money they need in reserves for the years that billions of dollars in claims are made. In fact, large insurance companies have billions of dollars in reserves at any given time and keep them in conservative investments, where even a 2% annual gain can still add up to billions of dollars.

Risks to Consider: Risks related to TRV include higher-than-expected losses from catastrophes (either natural or man-made), increasing pricing competition and a prolonged low interest rate environment.