Have you ever seen one of those funny videos where someone stands on a street corner and tries to hand out $10 bills?

Many people refuse the money and keep walking. But what if I told you there is a way to get far more than $10 in free money -- $332,307, actually -- and it is perfectly legal.

Most folks would say I'm crazy.

In another article I recently cited some disheartening statistics from a 2013 Employee Benefit Research Institute study:

- One of the primary vehicles for retirement savings is an employer-sponsored retirement savings plan, like a 401(k). Eighty-two percent of eligible workers say they participate in such a plan, and another 8% of eligible workers report they have money in such a plan, although they are not currently contributing.

- Cost of living and day-to-day expenses are the leading reasons why workers don't contribute (or contribute more) to their employer's plan, with 41% of eligible workers citing these factors.

Shocking, eh?

But there's more...

The report also said that only 10% of those working are contributing the legal maximum to their plan. The maximum annual contribution for a 401(k) is $17,500 ($23,000 if you are over 50). For a SIMPLE 401(k), the limit is $12,000 ($14,500 over 50). Also, many employers will match all or part of an employee's contribution.

I spoke with my CPA, David Kinard, about the limits; he told me about a large company in Atlanta that matches 100% of an employee's contribution up to 6% of their total salary and 50% of the next 2%, up to a maximum of 7% of the employee's salary, which is fairly typical.

To keep the math simple, consider a hypothetical employee, Bob Jones. Bob is 48 and makes $100,000 per year. Should Bob elect to put $6,000 in his 401(k), his employer matches it. Then it would also match 50% of the next 2%, up to 7% of Bob's total salary. In other words, should Bob decide to put $8,000 into his 401(k), the company will contribute $7,000. Right from the start, Bob has earned 87.5% on his money.

The money that Bob contributes to his plan is tax-deferred, meaning that his taxable income is reduced by that amount in the year he made the contribution. If Bob is in the 25% marginal tax bracket, he will reduce his current-year tax bill by 25% of the $8,000 he contributed. Of the $8,000 Bob contributes, he saves $2,000 in taxes; and his employer deposits an additional $7,000 into his account.

Free Money

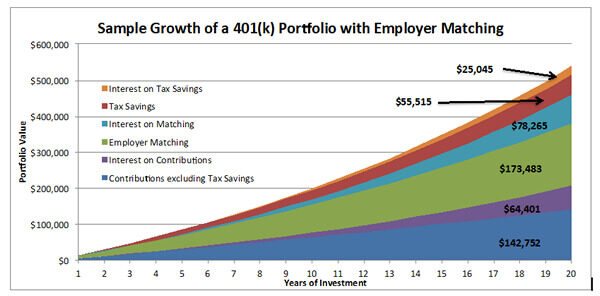

Imagine that Bob Jones just joined a new company and anticipates working there until he is 68. To be conservative, assume he will receive an average 2% cost of living raise annually. In addition, let's assume that the government will increase the maximum contribution at the same 2% rate each year. Bob's 401(k) is conservatively invested and earns an average of 4%. And since it's his salary that gets the match, let's assume he's filing separately in the 28% tax bracket.

I turned to Vedran Vuk, our senior research analyst, to answer a couple of questions about Bob. Over the next 20 years, how much would Bob accumulate if he just contributed 8% of his salary with his employer-matching deal? What if Bob contributed the maximum amount each year?

If Bob just contributes 8% of his salary, he will get an additional $539,459 at the end of 20 years. But most important, $332,307 will come from matching, tax savings, and interest earned on matching funds and tax savings. If Bob contributes the maximum, he accumulates an additional $790,220. It is free money.

So why would his company do this? It should come as no surprise that employers receive federal tax benefits for matching funds. But regardless of their motives, it is there for the taking.

If you're not maximizing your contributions, you might want to check with your personnel department. You might just find extra money waiting for you.