Not everyone will follow this advice, but I'm convinced that those who do will be better -- and wealthier -- investors because of it.

This article is going to be different than ones I typically write. I've decided not to profile a single company.

Instead, I want to change the way you think about investing. My goal is that by the time you finish reading this essay, you'll never buy a stock again unless you plan on owning it and letting it compound your wealth for years.

Sadly, based on experience, I can say confidently that most of you will not follow my advice. But I'm convinced that those who do will be better -- and wealthier -- investors because of it.

To illustrate my point, let me share with you an email we received from one of our subscribers last year.

For privacy, I won't publish this subscriber's name. But here's an angry email he wrote to us in the middle of a market sell-off. He was referring to the model portfolio for our Top 10 Stocks newsletter.

'The report should give an overview of performance and suggested stop-loss levels on the recommended securities.

'Frankly, the performance of late does not inspire.'

Now, I don't personally know this subscriber. I don't know which securities he owns in his portfolio, and I don't know his investing track record. But I'd be willing to bet that more often than not, this investor loses money in the market.

How do I know that? Because he is focused too heavily on short-term market swings.

The instant a stock falls, investors want to know whether they should sell. It doesn't matter if the underlying company is performing well or not -- the fear of losing money is simply too much for most small investors to stomach.

I'm convinced this is why most investors lose money in the market. The underlying problem is that most of us are prisoners of short-term thinking.

For literally thousands of years, humans have been conditioned to think in the short term. Our focus has been on survival. We needed to ensure we had another meal... a warm place to sleep... and that we were safe.

Even today, long-term thinking doesn't come naturally. That's why so many people have trouble saving for retirement... and why politicians always wait until the last possible moment to pass crucial legislation... and why so many investors focus only on the short-term -- fretting over day-to-day performance and forgetting that investments are meant to grow their wealth over a long period.

The good news is that even if you don't have decades to invest, you can still generate significant returns in a few years.

I've already explained one part of the process -- time. If your goal is to get rich 'overnight,' then you should go buy a handful of lottery tickets. By contrast, it takes years to earn truly life-changing wealth in the stock market.

That certainly doesn't mean you can't see gains of 20% or 30% in a year. But truly life-altering investments -- those that return hundreds or thousands of percent -- take years to reach their full potential.

But time alone won't make you wealthy. There's another factor that's much more important...

I'm talking about dividends -- namely, dividend growth.

Now, dividends aren't sexy. They don't grab headlines in The Wall Street Journal or get Jim Cramer shouting at the top of his lungs on CNBC.

But as I've explained in the past (in this article and this article), a solid company that grows its dividend each and every year can lead to a staggering amount of wealth over time.

I'm telling you this now because volatile markets are simply something investors will have to deal with for the foreseeable future. There will be times of calm, and I believe over the long term the market will move higher. But thanks to serious debt problems in the developed world and tepid growth worldwide, the market will continue to swing in the short term, sometimes wildly.

Although I'd love to see a steadily rising market, these sell-offs are opportunities to pick up shares of great stocks that pay rising dividends at bargain prices.

That's how I want you to view the market.

If you looked back at the past century, then you'd see there hasn't been a single sell-off that didn't later turn out to be a terrific opportunity to buy stocks, assuming you bought solid companies at attractive prices and had the resolve to hold them for the long term.

This includes the Great Depression... the sell-off in 1937... the sell-off between 1973 and 1974... the 1987 crash... the dot-com crash... and the most recent sell-off during the Great Recession. All of these times turned out to be wonderful opportunities to buy.

I understand why many investors get nervous. But successful investors use these periods to load up on solid stocks that have a proven history of raising their dividends -- and they generate enormous profits in the process.

This approach is supported by countless research and academic studies.

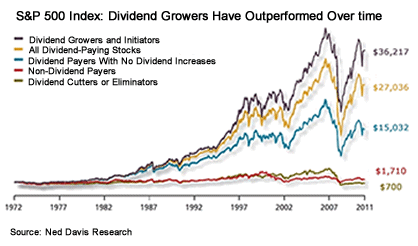

For example, dividend-paying stocks have a long history of outperforming the market through good times and bad. The chart below tells the whole story.

From 1972 through 2011, members of the S&P 500 that pay dividends returned 8.6% annually. That's enough to turn a $1,000 investment into $27,036. Meanwhile, non-dividend payers returned just 1.4% per year, turning that same $1,000 investment into just $1,710.

And as the chart clearly shows, companies that grow their dividends have done the best of all. That's why I look for companies that boost their payments to shareholders year in and year out.

I don't view stocks as lottery tickets, and I don't look to buy them one day and sell them at a higher price a few days or a few months later.

Stocks represent ownership in a business, and my goal is to invest in some of the world's greatest businesses and to hold those stocks for the long haul. If you're going to buy a stock and hold it for the long run, then as a rightful owner of the business, you should receive your fair share of the company's profits.

The Investing Answer: With this in mind, I don't personally invest a cent in any business unless it pays a dividend. And when I see the right cash-rich, dividend-growing stocks trading at bargain prices, especially in an uncertain market like this one, I'm always ready to snatch them up. If you have the cash, you should be on the lookout as well -- there are plenty of great opportunities to be had right now.