Investors clamoring for an opportunity to invest in sand are in luck.

With its recent IPO, U.S. Silica (NYSE: SLCA) became the first publicly traded pure play industrial sand producer.

An industrial sand stock may not be received with an equal level of excitement to that of the latest social media stock but maybe it should, considering sand is a key component in industries such as energy exploration.

Sand's Newfound Demand

Fracking is a relatively new drilling technique used to extract previously 'unextractable' energy resources.

In other words, fossil fuels that were once viewed as trapped in the ground forever are now being released thanks to fracking.

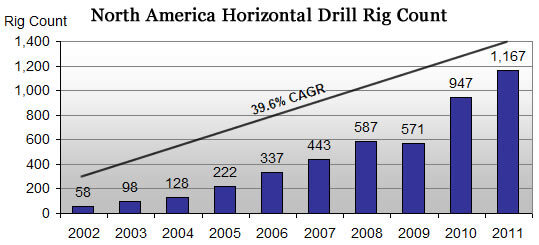

This has created a flurry of new drilling activity in North America.

As a result, sand demand is increasing because it's a key component in the fracking process. Frac sand demand has increased at a rate of 28% a year since 2004 and it's expected to increase 15% a year over the next three years.

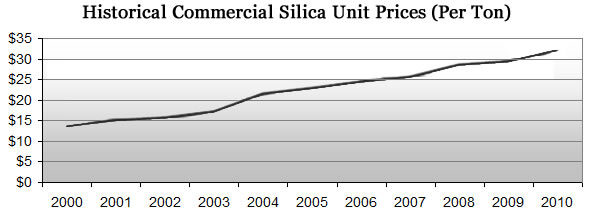

Sand's newly discovered role in energy exploration is creating a supply squeeze. This explains the rising price of silica sand over the past several years.

Soaring prices are prompting some degree of vertical integration in the energy sector. EOG Resources (NYSE: EOG) bit the bullet and bought a frac sand company. Pioneer Natural Resources (NYSE: PXD) did the same; shelling out nearly $300 million for Carmeuse Industrial Sands.

More acquisitions will likely follow and U.S. Silica could be a takeover target. But buyout speculation aside, this company still looks like a great investment opportunity.

A Sand Stock On The Rise

U.S. Silica has developed a strong and diverse customer base in its century-long existence.

The customer base is strong because it includes major corporations like The Sherman Williams Company (NYSE: SHW), Owens Corning Inc (NYSE: OC), PPG Industries (NYSE: PPG), Schlumberger Ltd (NYSE: SLB), Halliburton (NYSE: HAL), Nabors Industries (NYSE: NBR), Weatherford Intl (NYSE: WFT) and Baker Hughes Inc (NYSE: BHI).

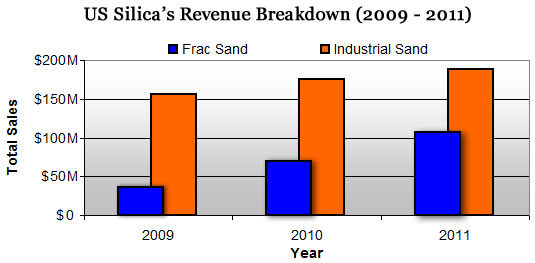

The customer base is diverse because these corporations serve multiple markets. As a result, U.S. Silica's revenue stream is diverse; and revenue is also growing…fast; particularly in frac sand sales.

The company expects 2012 sales to come in near $400 million, up from roughly $295 million in 2011.

The bottom-line promises to be equally impressive. Analysts predict earnings of $2.08 a share in 2013. That means shares are currently trading at slightly less than 10 times forward earnings. This paltry P/E tells me the market fails to understand the potential of sand.

The Investing Answer: U.S. Silica's recent market debut offers investors the opportunity to participate in the growing (yet overlooked) market for sand. I recommend giving this stock some close consideration and possibly snapping up some shares ahead of the crowd.

Editor's note: Data compiled from U.S. Silica's annual report, which can be found here.

A. Crawford does not personally hold positions in any securities mentioned in this article.