Question: What is beta, and why should it matter to me?

-- Ramy S., Lebanon

Answer: There are two main goals in investing: making money, and not losing money. It's as simple as that.

How you feel about those two goals is probably determined by your age. Younger investors are willing to take risk, seeking stocks that might eventually double or triple in value. Older investors just want to hang on to their nest egg, generating respectable income streams from a portfolio of mature, steady-as-she-goes stocks.

Yet even with these goals in mind, investors may unwittingly end up owning the wrong kinds of stocks. Perhaps the easiest way to know if you own the right stocks: Check the beta.

What Is Beta

Beta is a measure of how fast a stock rises and falls in relation to the broader stock market. For example, a stock with a beta of 3.0 will rise (or fall) three times as fast as the market. A stock with a beta of just 0.25 will move up or down more slowly, even when the rest of the stock market is making a bold move in either direction. A beta of 1.0 implies one-to-one parity with the market.

Perhaps no sectors embody the notion of beta like the technology and utility sectors. An electric utility company such as New York-based Con Ed (NYSE: ED) is the proverbial tortoise in the race against the hares, with a beta of 0.18. Its dividend grows just 1% every year but is as predictable as the sunrise. That is not necessarily a virtue to younger investors who seek stocks capable of robust share price gains.

Younger investors may prefer tech stocks, which are famous for surging (in the late 1990s) and crashing (a few years later). Perhaps the most popular high-beta stock of the past five years has been Apple (Nasdaq: AAPL), which rose more than 600% from early 2009 through the summer of 2012 but has since fallen roughly 40%. That's often too much action for conservative investors who are nearing retirement.

But wait: Why can't aging investors latch on to a fast-moving high-beta stock like Apple? They can and do. Indeed, it's wise to hold a few high-beta stocks in an otherwise low-beta portfolio. They can add some growth to a portfolio that is otherwise mostly focused on income.

How To Determine The Beta Of Your Portfolio

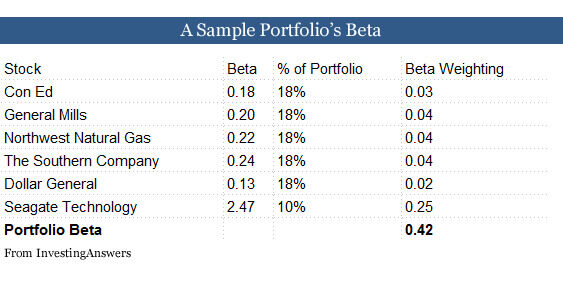

The key is to know the beta of your portfolio, and calculating it is quite simple. Let's presume you own five low-beta stocks (which account for 90% of your portfolio), with the remainder of your portfolio in computer component maker Seagate Technology, which has a beta of 2.47.

Simply multiply each stock's beta by the percentage it is in your portfolio, and then add up the figures. Here's an example.

Even with the addition of a high-beta stock, this portfolio still has a total beta of only 0.42, which is quite low.

It may be helpful to first establish what kind of portfolio you want to have. Perhaps you would like it to be neither too risky nor too conservative, and therefore seek a portfolio of a beta of 1.0. If your current portfolio is above or below that figure, you can sell certain stocks and replace them with others that help bring the beta toward the 1.0 mark.

Bottom Line

Investors tend to buy and sell stocks without paying attention to the broader risk profile. By tracking the beta of your portfolio, you'll develop a very clear sense of whether you are too tilted toward growth or risk aversion.