What Is Cost-Benefit Analysis?

Cost-benefit analysis is used to analyze a potential investment that will impact a business. Whether a company is looking to purchase a new property – or expand its operations – cost benefit analysis is an important part of the decision-making process.

How to Do a Cost-Benefit Analysis

To perform cost-benefit analysis, analysts or managers add the total benefits from a specific action and then subtract the estimated costs of taking that action. This calculation helps determine whether the action will be profitable for the business.

The first task in a cost-benefit analysis is gathering all necessary data to determine the cost. This includes the following:

- Direct costs- raw materials, inventory, labor, and other direct manufacturing costs

- Indirect costs - utility cost, real estate, and management costs

- Intangible costs - goodwill impairment, unforseen customer reaction, potential legal/liability costs, delivery delays, and employee impact/labor diversion

- Opportunity costs - time diverted from the company’s core business, loss of market share due to management diversion, or growing organically versus by acquisition

- Cost of risks - environmental, regulatory, competition, etc.

Once costs are determined, the following benefits may apply:

- Sales, revenue, and earnings growth (thanks to increased capacity or a new product)

- Market share increase

- Intangible benefits (e.g. increased brand equity, customer satisfaction, employee morale)

How Costs Are Determined

An analyst or project manager will assign monetary values to both costs and benefits for projects or investments. It’s important not to overestimate or underestimate these.

If the benefit outweighs costs, the project can move to the next phase. If the costs outweigh benefits, management can cancel the action entirely.

Cost Benefit Analysis Example

Let’s say a real estate company wants to purchase a new investment property. They have two in mind but need to make the most profitable decision. It would be prudent for the company to conduct a cost-benefit analysis to compare the profitability of the investment options.

The company will need to:

Estimate the total costs and benefits of each investment option

Input this data into a cost-benefit analysis formula

Use the results to determine the best investment

In Depth Cost-Benefit Analysis Calculations

There are two main models used when conducting a cost benefit analysis: Net Present Value (NPV) and the Benefit-Cost Ratio (BCR).

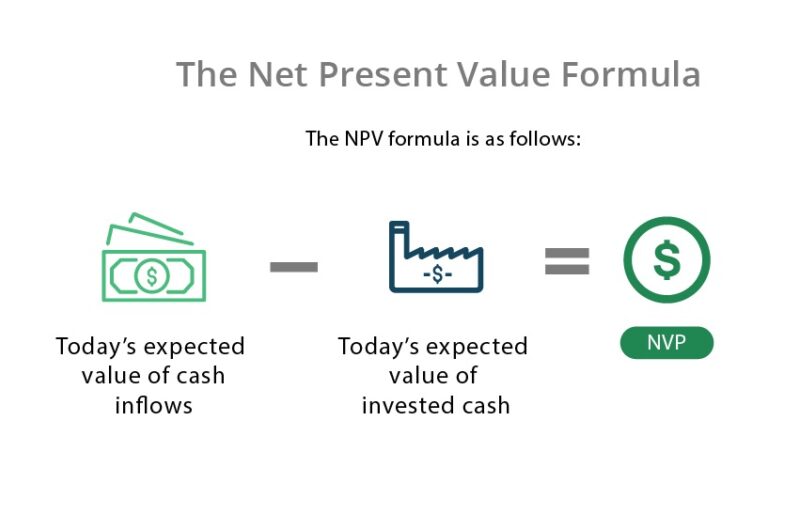

Net Present Value (NPV)

Net present value (NPV) calculates cash inflows from the investment and subtracts cash outflows from the investment. NPV also factors in the time value of money by discounting all cash flows to their present value. An NPV analysis uses a discount rate - The rate at which future cash flows are adjusted to present values, which accounts for factors such as inflation and other pertinent risks.

In order to calculate NPV:

1. List all the costs associated with a certain project. Do you need to buy new equipment, hire new people, or spend money on marketing?

2. Estimate the monetary values of each item on the list. How much will equipment, hiring, marketing, etc. cost?

3. Place a dollar value on the project’s benefits. How much money will you generate from sales?

4. Figure out the discount rate for your project, taking into account all risks.

5. Discount all cash flows.

6. Compare the value of the costs to the value of the benefits: Which one is greater? Does it make financial sense to go ahead with the project?

The Net Present Value Formula

The NPV formula is as follows:

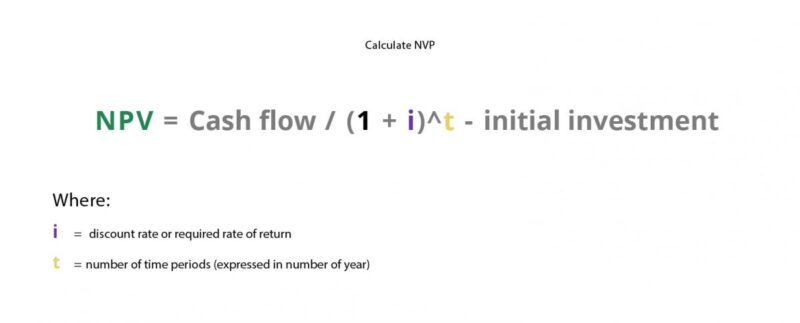

In more complex terms, if you analyze a project that will realize potential gains or losses after one year, you can calculate the NPV as:

if you analyze a project that will realize potential gains or losses after t years, you can calculate the NPV as:

NPV=0tCFt(1+i)t

Where:

t = number of time periods (expressed in number of years)

i = discount rate or required rate of return

CF = the expected cash flows at Time t

If the NPV is greater than 0, the action taken will have a positive financial impact on the business. If it’s negative, there will be a financial loss.

NPV Calculation Example

Let’s say a manufacturer wants to expand its product line. The company plans to invest $100,000 on new machinery, $25,000 in hiring a new salesperson, and $25,000 on marketing. We can add these cash outflows (or costs of investment) to generate a total projected cost:

Now, let’s say the salesman is expected to generate $350,000 in sales (cash inflow) from the new product within the first year.

Take the estimated benefits and subtract them from the costs, with a discount rate of 10%, to get the NPV for one year:

NPV = $350,000 / (1 + 0.10)^1 - $150,000 = $168,181

The company would stand to increase its value by $168,181 after one year. In this case, the benefits outweigh the cost.

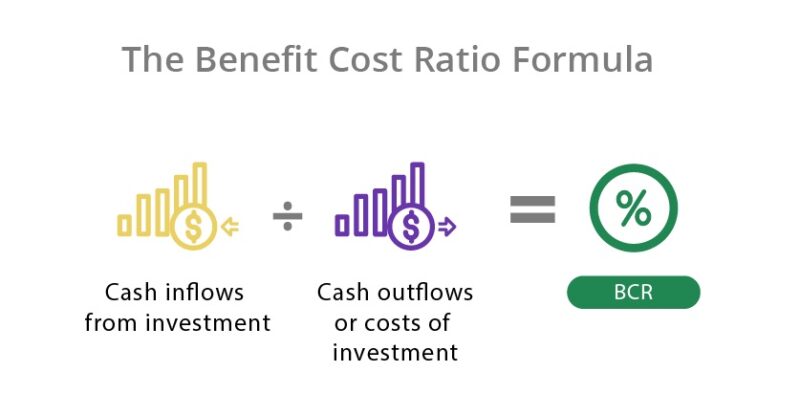

Benefit-Cost Ratio (BCR)

Because a cost-benefit analysis should be performed thoroughly, many companies don’t rely on a single model to determine the financial outcome of a project. Calculating the BCR is another way to gain confidence in a proposed project while determining if a project will deliver a positive or negative NPV.

The Benefit-Cost Ratio Formula

The formula for the Benefit Cost Ratio is as follows:

In general, the greater the value above 1, the more likely a project will be beneficial. If the number is less than 1, then the project's cost will be greater than the returns. In this case, the project should not be carried out. A number equal to 1 means the costs should be about the same as the benefits.

Net Present Value vs. Benefit Cost Ratio

Analysts will use both NPV and BCR to conduct a cost benefit analysis for a project. Using these models provides more comprehensive results.

One model is not necessarily better than the other. Each formula may provide different numerical results, but can actually lead to the same conclusion. Let’s look at the cash inflow and outflow for one scenario to understand this better.

Suppose the present values of cash inflow from investments are $20 million while the present values of cash outflows are $16 million. Using the NPV and BCR formulas, we are given both a number and a ratio:

- NPV = $20 million - $16 million = $4 million

- BCR = $20 million / $16 million = 1.25

Both the NPV and the BCR point to the same conclusion: This is a profitable investment.

Once a company understands whether an investment is profitable, it can decide to fund the project. Of course, a company can’t fund every single project (unless it has an unlimited budget) but it can use the information provided from both the NPV and BCR cost benefit analysis to:

- rank projects from most to least profitable

- compare which project is more profitable

Pros and Cons of Cost-Benefit Analysis

Cost benefit analysis is one of the best ways for a company to analyze a choice while uncovering unexpected costs and/or benefits.

For small-to-medium sized projects (that have a relatively short time to completion), a thorough cost benefit analysis is the best approach.

When considering a large project with a long time span, cost-benefit analysis presents some drawbacks. The biggest drawback is that the longer the project continues, the harder it is to predict the future cash flows. It can also be harder to predict:

- inflation

- weakened economic conditions that affect cash flow

- political or regulatory uncertainty

- rapid technological changes

- a shift in consumer tastes

Cost benefit analysis may also be inaccurate due to biases in predicting cash flows, incorrect estimations, and a reliance on previously collected data. Experienced analysts and managers work to avoid these kinds of inaccuracies.

Generally speaking, a cost benefit analysis is always helpful when any company tries to make an informed (and profitable) decision.