When money is saved in an interest-earning account, that interest builds over time. This is also known as compound interest. With our easy savings calculator, you’ll be able to determine how much you’ll accumulate if you save the same amount of money each month.

How to Use Our Free Simple Savings Calculator

To use this InvestingAnswers calculator, you’ll need to have four numbers:

-

Current amount you already have saved (this could also be your initial deposit)

-

Your monthly savings amount (what you plan to put in the account each month)

-

The annual rate of return (how much interest your account earns)

-

The number of years you plan to save

It’s okay if you don’t have these numbers all figured out yet: You can run the calculation multiple times to see how different amounts, higher interest rates, etc. will change your prospective savings.

Savings Calculator Example

Say that you currently have $5,000 in savings. If you save $200 a month for 30 years – with a 7% return on your money each year – you would enter the following information:

-

Enter "$5,000" as your Current Amount Saved.

-

"$200" as the Monthly Savings Amount

-

"30" as the Number of Years

-

"7%" as the Annual Rate of Return.

If you start with $5,000 and save an additional $200 each month (while earning 7.00% on your investment), after 30 years, you’ll have $284,576.69

How the Interest Rate Affects Your Ending Balance

With interest rates being as low as they have been in recent years, the short-term effect of the rate on your ending balance may seem insignificant, at least in the short run.

But the interest rate you earn on savings does have a significant effect on your ending balance. That’s because the interest you earn compounds over time.

In its simplest form, compound interest is earning interest on your interest.

For example, let’s say you invest $5,000 in a five-year certificate of deposit that pays a rate of 2%, compounded annually.

At the end of the first year, your CD will be worth $5,100, which includes $100 in interest.

When the interest is credited at the end of the second year, it will reflect interest earned on both your initial invested principal and the interest earned in the first year.

Your CD will grow to $5,202 by the end of the second year, comprised of the following:

-

Your initial investment of $5,000, plus

-

$100 interest earned in the first year, plus

-

$102 interest earned in the second year.

Notice that the interest earned in the second year is higher than that earned in the first year by $2. That’s the interest earned on the $100 of interest earned in the first year of the CD.

When the CD matures at the end of five years, you’ll have a total of $5,520. That will include $5,000 from your initial investment, plus $520 in interest.

If the interest rate on the CD didn’t compound, you would earn only $500 in interest over five years. The difference of $20 represents the effect of compounding on your return.

In this example, we’ve used annual compounding. But if a bank offers daily compounding – which most do – the interest earned will be even higher.

The greater the frequency of compounding, the more interest will be earned, assuming the interest rates are equal.

How Your Ongoing Deposits Affect Your Ending Balance

The amount of money you’re able to accumulate will be determined by four factors:

-

Your initial deposit

-

The interest you earn on your savings

-

Ongoing deposits added to your account

-

The amount of time you have to save money – we’ll cover this factor in the next section

We covered the importance of interest rates in the previous section. But adding ongoing deposits to your account will likely have a much bigger impact - especially at lower balances.

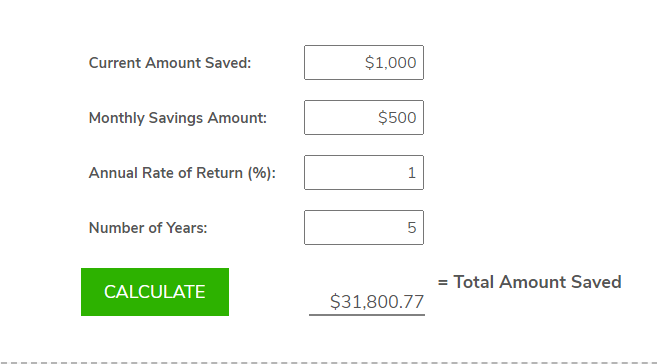

For example, let’s say you want to purchase a home in five years, and you’ll need at least $30,000 for the down payment. You also want a few thousand extra to cover incidental and unexpected expenses.

To reach your goal, you open a savings account with $1,000 and an annual interest rate of 1%. By depositing an additional $500 per month into your account, you’ll have the following balance after five years:

You can increase the amount of savings you’ll have at the end of the desired time horizon either by making larger monthly deposits or by extending the number of years to reach your goal.

How Time Affects Your Ending Balance

The longer your savings time horizon is, the higher your ending balance is going to be. It’s a simple matter of having more time to both earn interest and make monthly savings deposits.

Conversely, a shorter time horizon will result in a lower balance.

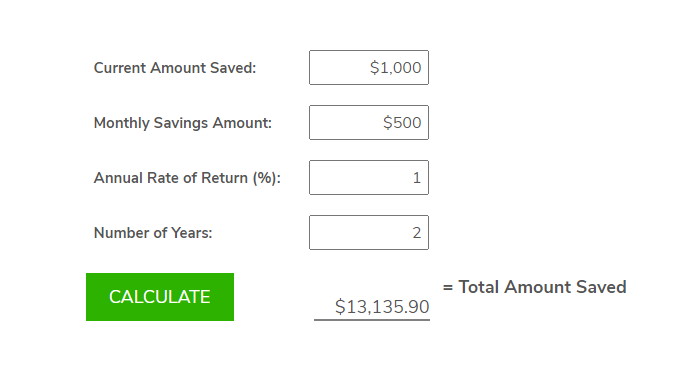

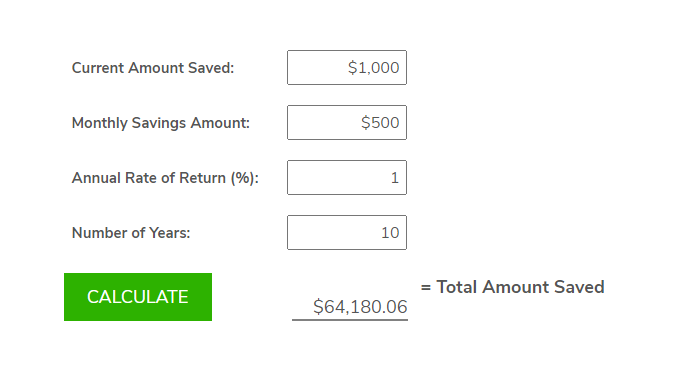

Let’s rework the example above but use time horizons of two years and 10 years.

With a two-year time horizon, your ending balance will be much lower:

But if you extend the time horizon out to 10 years, the balance will be considerably higher:

When planning your savings goals, you’ll need to consider your time horizon. Smaller savings goals can be accomplished in less time. But if you need to accumulate a larger amount of savings, you’ll need to allow more time to reach your goal.

How Much Should You Save?

Saving is different from investing.

Investing, such as in a brokerage account or retirement account, should not be seen as savings. Investing often means putting your money in the kinds of higher risk/higher reward assets -- such as stocks -- that can fall in value and require a commitment of many years.

Savings, by contrast, is held in safekeeping for immediate or near-term use. You'll likely earn less but you'll have no risk of losing money due to market fluctuations. If you are keeping your savings in a savings account it is also probably FDIC insured -- which protects you from bank failure as well.

A savings account is often used for an emergency fund. That’s money allocated for unforeseen circumstances, like a large, unexpected expense, or even an income disruption. Since the timing of the need to access the fund can’t be known, the money should be held in a safe, liquid form, like a savings account or money market.

Financial experts recommend maintaining sufficient cash to cover between three- and six-months living expenses in your emergency fund. For example, if your basic living expenses are $3,000 per month, your emergency fund should have between $9,000 and $18,000.

Once you have a well-stocked emergency fund, you can then begin saving for large purchases. These can include events like buying a car, preparing for an upcoming wedding, or saving for the down payment on a home.

Since the cost of the major purchases can be known, you’ll have a specific savings target. For example, if you’re planning to buy a home in three years, and you’ll need $30,000 for the down payment, you can determine how much you need to save by dividing $30,000 by the number of months between now and the home purchase, as follows:

$30,000 divided by 36 months = $833.33

That’s the amount you’ll need to save each month between now and the anticipated time of the home purchase. You'll also earn some interest along the way from your savings account which will help grow your savings faster.

Much like an emergency fund, savings for major purchases should be held in a safe, liquid account to avoid the risk of loss from market fluctuations -- assuming you'll be making that purchase in the next five years.

If you're saving for the long term, over 5 years, you may want to look into investing to earn more than just interest.

How to Maximize Your Savings

Saving money requires an action plan with several steps:

1. Create a budget. Sign up for a budgeting tool like Mint or YNAB to get an accurate picture of exactly where your money is going. Next, determine expenses you can either reduce or eliminate entirely. The idea is to create additional space in your monthly budget for savings.

2. Make saving automatic. The best way to do this is by setting up payroll deductions. Similar to 401(k) contributions, you can allocate a portion of your pay to go directly into savings. By automating the saving process, you can make it happen without any effort on your part.

3. Save financial windfalls. This is one of the best ways to fast-forward your savings efforts. The next time a large chunk of money comes in, put it right into savings. Examples of financial windfalls include bonus income, a gift or inheritance, or an income tax refund. According to the IRS, the average federal income tax refund is $2,924. That will be a nice addition to the payroll deductions that are already going into your account.

4. Look for higher interest rates. The average rate on a savings account nationwide is a dismal 0.06%. But there are banks paying rates eight to 10 times higher. You owe it to yourself to take advantage of higher rates, wherever they’re available. It’s an opportunity to give your savings a boost, even if it’s only a small one.

5. Don’t get distracted. While you’re working to build your savings, there will always be competition for your money. Small money leaks can really add up over time. The more you can avoid distractions the faster you’ll reach your savings goal.

Depending on the importance of the savings goal, you may also want to consider ways to increase your income to enable adding more savings. For example, you can take a part-time job or even do odd jobs to increase your income. If the amount of additional savings desired is relatively low, the additional income arrangement may only need to be temporary.

Best Savings Accounts

The lineup of banks paying high interest is always subject to change.

Some of the best examples include:

The interest rates offered on savings accounts do fluctuate. If you’re concerned rates will fall, you may want to consider using CDs instead. You can lock-in your rate for anywhere from three months to five years, to guarantee the desired interest rate for the term needed.