What are Stochastics?

This is a momentum indicator that shows the location of the current close relative to the high/low range over a set number of periods.

Momentum indicators try to identify turning points by measuring how fast prices are rising or falling.

How Do Stochastics Work?

The calculation of the stochastic can be confusing.

First a value known as %K is calculated with this formula:

%K = 100*((C-L14) / (H14-L14))

C is the most recent closing price; L14 is the lowest price in the last fourteen periods; and H14 is the highest price in the last fourteen periods. We used 14 as an example, but any number can be used here.

A 3-period moving average of %K is then calculated and called %D (no one really knows where the names came from, but they are widely used in almost all software packages). A buy signal is given when %K crosses above %D and sell signals occur when %K falls below %D.

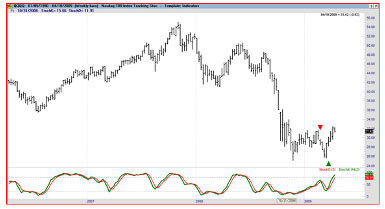

An example is shown in the image below.

Image: The stochastics indicator offers clear trading signals. Only one trade is highlighted in this chart, but there are more than a dozen signals shown.

For stochastics, readings below 30 are considered oversold and you would only take buy signals if the indicator is below that level. A value of 70 is considered overbought and sell signals occurring below that level would be ignored. This leads to longer trades and should result in fewer losses.

Why Do Stochastics Matter?

One problem with using indicators to generate trading signals is that there are a large number of losing trades. One way to improve the odds of a winning trade is to ignore signals unless the market is at an oversold or overbought extreme.