Would you ever invest in a company because the Super Bowl results told you to? Or because an American model graced the cover of the Sports Illustrated swimsuit issue?

Would you be surprised if I told you that some people do?

There are dozens of bizarro strategies that 'tell' people when to buy and sell. The Lipstick Indicator. The Hemline Index. The amount of Aspirin and Tylenol sold.

And then there's this one: the Dogs of the Dow.

Sounds weird, right? Well, on the surface it is.

But regardless of its out-there name, it's a solid investment strategy based on a few common-sense concepts. But I'll get to that in a minute.

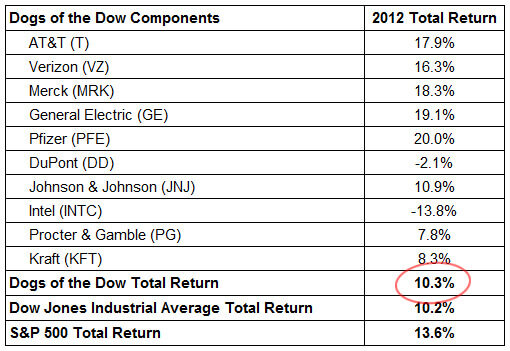

First, the strategy's astonishing results: This totally bizarre strategy has outperformed the stock market for seven of the last 10 years. That's an unheard-of 70% accuracy. (Most professional stock brokers would kill for those kinds of numbers. As a group, only about 15% of mutual fund managers are able to beat the S&P 500 in any given year.)

Now you're probably wondering about how this all works.

The Dogs of the Dow isn't anything complicated. In fact, it's just a puffed-up name for the 10 Dow Jones Industrial Average companies with the highest dividend yields. That's not to be confused with dividend payments -- we're talking about how much return (expressed as a percentage) you can expect from these ultra-safe companies.

[InvestingAnswers Feature: Dow Know-How: What Moves the World's Most-Watched Average?]

Easy enough, right? Right. So here's the strategy:

On the first trading day of the year (in 2013, it's January 2), you identify the 10 highest-yielding Dow companies. Then, you buy them. On the last trading day of the year, you sell them. And then get ready to buy the next set of Dogs in a few days, when the market opens again.

So, in summary:

- First trading day of the year -- BUY 10 highest-yielding Dow companies.

- Last trading day of the year -- SELL said companies.

Rinse and repeat. See? Simple.

So now you know the WHAT and the HOW. Let me pull the curtain back on the WHY.

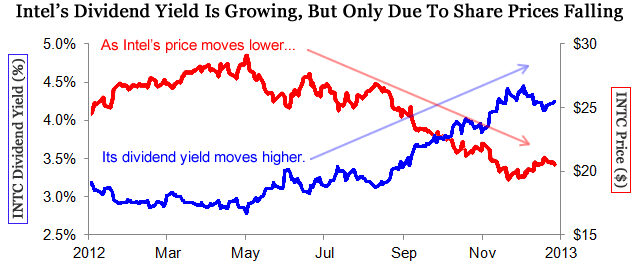

When a company has a higher-than-average dividend yield, it's for one of two reasons:

- The company pays a higher-than-average dividend.

- The company pays an average dividend but has recently seen share prices fall, as seen below.

The benefits of the first possibility are obvious -- high yield, low risk, all win. But the second possibility seems counterintuitive. Buying a losing company can be a risky proposition. We've all heard horror stories about stock prices that keep falling and falling and falling...

[InvestingAnswers Feature: The Absolute Worst Way to Invest in a High-Yield Stock]

And generally, that's a legitimate point. But these are Dow companies -- they're huge, safe and basically regarded as the bellwethers of their respective industries. In short, they're McDonalds. Intel. Disney. AT&T. It would take a serious blow to knock one down permanently. In almost every case of a depressed share price, it's only a matter of time before it pops back up to a more normal price.

Which brings me back to those common sense concepts. The Dogs of the Dow doesn't work because of weird investing voodoo magic. It works because, whether or not you're aware of it, you're following two of the most basic smart-investing principles:

You're receiving higher-than-average dividend payments from super-low-risk companies.

You're buying at lower prices and selling at higher prices.

The Investing Answer: Next week, investors will swap out this year's Dogs for next year's. With only one trading day left in the year (and we're not expecting things to move too much), it looks like they'll pocket a nice profit, slightly higher than the Dow's total return, but just missing the S&P 500's.

Some 2012 Dogs will make the list for 2013, but there will be at least one new face because Kraft (NYSE:KFT) was kicked out of the Dow earlier this year when it split its business into two separate companies. As of today's market close, the Dogs for 2013 will be AT&T, Verizon, Intel, Merck, Pfizer, General Electric, DuPont, Hewlett-Packard, Johnson & Johnson and Microsoft.

And while I personally would never buy a company without researching it thoroughly, it's hard to deny the results this strategy delivers.