What is Times Interest Earned?

The times interest earned, also known as interest coverage ratio, is a measure of how well a company can meet its interest-payment obligations.

The formula for times interest earned is:

Earnings Before Interest and Taxes/ Interest Expense

Times Interest Earned -- Formula & Example

Here is some information about Company XYZ:

Net Income $350,000

Interest Expense ($400,000)

Taxes ($50,000)

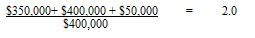

Using the formula and the information above, we can calculate that XYZ’s times interest earned is:

This means that XYZ Company is able to meet its interest payments two times over.

Why does Times Interest Earned matter?

In general, a low times interest earned ratio suggests a company is overleveraged, while a high times interest earned ratio may suggest a company is “too safe” and is neglecting opportunities to magnify earnings through leverage. A times interest earned ratio below 1.0 indicates that a company is not able to meet its interest obligations.

Because a company’s failure to meet interest payments usually results in default, times interest earned is of particular interest to lenders and bondholders and acts as a margin of safety. However, because times interest earned is based on current earnings and current expenses, it primarily focuses a company’s short-term ability to meet interest obligations.

Some industries tend to have higher times interest earned than others, and cyclical companies in particular can experience significant swings in their times interest earned (especially during recessions). Thus, comparison of times interest earned is generally most meaningful among companies within the same industry, and the definition of a 'high' or 'low' ratio should be made within this context.