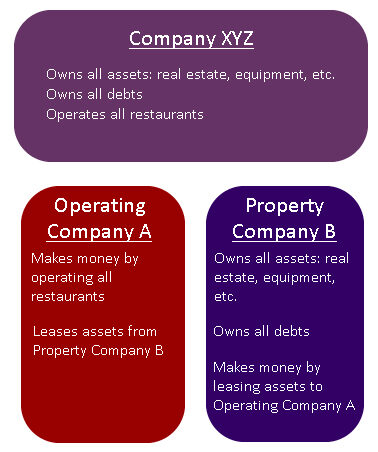

What is Operating Company/Property Company (Opco Propco)?

An operating company/property company deal (opco propco) is a strategy in which a company is divided into at least two parts: a property company that owns all the real estate and assets associated with generating revenues, and an operating company that uses those assets to generate sales.

How Does Operating Company/Property Company (Opco Propco) Work?

Let's say Company XYZ is a restaurant chain with 10 units. If Company XYZ wants to implement an opco propco deal, it might sell its operating assets to a newly formed subsidiary (the propco). The remaining entity, which runs the business (the opco), might then lease the operating assets back. This is called a 'sale-leaseback.'

In turn, propco typically has much more collateral and thus can support more debt (partly because collateralized debt tends to be cheaper). Holding this debt within the propco means that the credit ratings and debt service on the debt are attached to the real estate subsidiary rather than the operating subsidiary.

Why Does Operating Company/Property Company (Opco Propco) Matter?

The opco propco strategy allows companies to keep debt (and thus credit ratings, debt service obligations, and associated issues) off the books of the operating company, which can be a considerable advantage. In some cases, the operating company might create a real estate investment trust (REIT) for its real estate holdings, which helps it avoid being taxed twice on its income distributions. However, when property values fall or credit markets tighten, the opco propco deal is often much less practical or feasible.