In broad range sell-offs, everything from blue chips to micro-caps gets hammered. That’s what you get in today’s world of program-trading, where the majority of trading is done by computers. Humans have learned to get out of the way and sell into downdrafts.

By Tuesday mid-day, more than 200 stocks were making 52-week lows – nearly the most we’ve seen in 18 months. (The recent “flash crash” saw hundreds of stocks hit lows, but that was due to a flaw in trading systems).

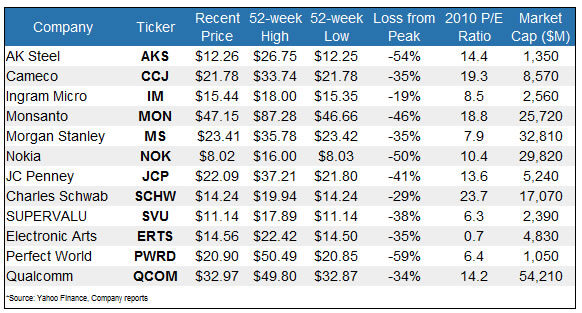

We’ve compiled a short list of mid and large-cap names we think are being indiscriminately sold.

There’s no assurance that these stocks will bounce back in the near-term, but if you’ve got a long-term time horizon, you’re getting a rare chance to buy some strong companies at bargain-bin prices.

Let’s take a closer look at three of these firms.

Ingram Micro (NYSE: IM)

Just two months ago, executives at Ingram Micro could sit back and relax. The leading computer and electronics distributor had just reported a stellar set of results that clearly established the fact the global economic slump had passed. Sales were rising and costs were lean. Operating expenses, as a percentage of sales, plunged to 4.1%, well below the 4.7% to 4.8% historical average, leading to a third straight quarter of higher-than-expected profits.

All management had to do was keep hitting their targets and then watch analysts boost their estimates. Sure enough, the 2011 per share profit forecast climbed above $2. The company had not earned $2 per share at any point in the last decade.

But the past few weeks have not been kind, and shares of Ingram Micro dropped in 9 of 10 sessions to hit a 52-week low on Tuesday. Fear of a slowdown in Europe, where the company derives about 25% of sales, are the key concern.

Although Ingram Micro won’t deliver quarterly results for another month, it may be safe to assume that 2011 EPS will be closer to $1.50 than the $2 that analysts currently forecast. Even with that haircut, shares look like bargain at just ten times that revised forecast. Furthermore, the stock is trading at only about 85% tangible book value. At these levels, the company may look to restart a share buyback program they’d previously put on hold.

Nokia (NYSE: NOK)

Nokia has made a litany of mis-steps that have left shares selling on the cheap. But now they’re ultra-cheap, touching a 13-year low on Tuesday. The company’s high-degree of exposure to Europe will certainly be painful, but at some point the entire “Euro scare” is being overdone. Business in Europe is likely to slow this year, but Nokia is prices as though Europe will fall off a cliff. And it’s unclear if things will really be that dire.

Nokia is suffering from what’s known as a “lack of timeliness.” In the absence of any near-term catalysts, investors have few incentives to buy. So they are letting sellers dictate the trading action.

But here’s a potential catalyst for you: Nokia has $11 billion in cash, and $6 billion in cash net of debt. While management waits for Europe to get past this crisis, it can sop up a lot of shares while they are out of favor. A decade ago, after the dot-com implosion, Nokia bought stock and ultimately reduced the share count from 4.8 billion to 3.7 billion. The company could use its cash to buy back another 700 million shares right now for about $5.6 billion, which would boost EPS by nearly 20%.

Charles Schwab (Nasdaq: SCHW)

When the stock market slumps, retail investors get spooked. And if they’re trading less, it means that fewer trading commissions are earned by online brokers. That’s bad news for Charles Schwab. The company has seen its shares rise and fall with the market, and they hit a new 52-week low on Tuesday.

Over the last few years, Schwab has significantly boosted its client base. You wouldn’t know it from the company’s stagnant revenue base. But when the market and the economy find firmer footing, that much larger client base should power the income statement to new highs.

Action to Take --> Ingram Micro, Nokia and Charles Schwab may be seeing secular headwinds right now, but these companies have survived hard times before. Today, their shares are disproportionately beaten down. They may drift lower still, but their considerable base of assets should set a floor not too much lower than the levels they’re at today.