My dad has been running our family farm in northern Illinois for more than 40 years. I grew up riding tractors, feeding cows and running through corn fields, though admittedly I never took to the business of farming.

Growing up on the farm, I knew one thing for certain: Every single day, my dad would be in the barn at 5 a.m. and 5 p.m. to milk the cows.

For nearly 30 years, he lugged 40-pound milking machines to and from each cow, twice a day, every day. When the milking was done, each machine had to be disassembled, washed and sanitized. Then the machines were put back on the shelves, only to be taken down again 12 hours later.

As the proverb goes, 'The trouble with a milk cow is she won't stay milked.'

Watching him come home exhausted every night, I wasn't surprised the day he walked into the kitchen and said, 'I just sold the herd.'

To hear him tell the story, it took a stubborn farmer 30 years to learn a simple lesson: It's easier to tend to an investment that can tend to itself.

I follow this advice, too. I look for a great stock that can more or less tend to itself.

That means finding the best companies in the world, buying their stocks and holding them for the long run.

When you buy stocks that tend to themselves, you don't need to spend hours memorizing complicated equations, trading patterns or performance ratios. You don't need to follow the markets every day. You don't really need to follow the markets at all.

Companies that pay dividends are the perfect example.

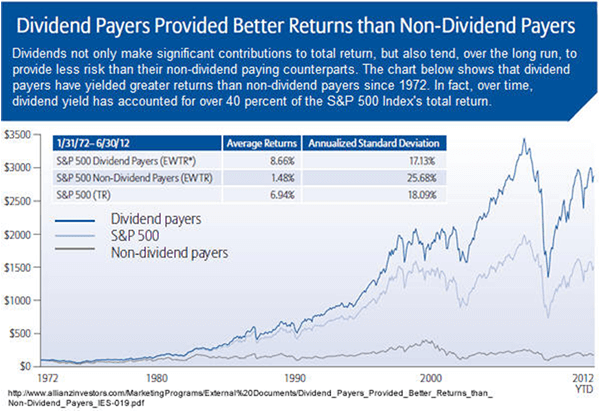

The fact is, dividend payers provide better returns than non-dividend payers AND with less risk.

A study published by Allianz Global Investors proves as much. It shows that in the 40 years through June 2012, S&P 500 dividend payers returned almost 8.7% annually versus a paltry 1.5% for non-dividend payers. That's a nearly six-fold (or 600%) increase in returns.

Even better, all that extra return came with lower risk (represented by a lower annualized standard deviation, which is a measurement of stock risk).

And when it comes to shareholder love, the past is a great indicator of the future.

Just like a bank uses your FICO score to decide if you're a good prospect for a loan, I like to use a company's dividend history as part of its 'corporate FICO score.'

Like an individual with a long-term record of paying bills on time, a company that has demonstrated a long-term commitment to paying dividends can be better trusted to keep paying dividends long into the future.

But dividends aren't the only way companies can return money to shareholders. A company can also buy back its shares -- theoretically increasing the profits that flow to the remaining shareholders.

In other words, by reducing the number of people who want a slice of the profit pie, each person can have a bigger slice.

The Investing Answer: Does the company pay a dividend? Has it been paying and/or increasing its dividend for a long time? Type '[Company name] Investor Relations' into Google and you'll be directed to the part of a company's website that should summarize its dividend-paying history. This page should also list share buyback announcements.

Ask yourself, 'Does this company have an impressive dividend record and/or history of buying back shares?' If you can answer 'yes,' the stock can stay on the list of 'safest stocks' candidates.