The headlines coming out of Iraq these days are quite alarming. The terrorist organization, Iraq/Syria Islamic State (ISIS), has reportedly robbed banks, executed enemies and recently seized control of Syria's largest oil field.

These extreme militants have and will continue to have a strong impact on crude oil prices. I believe it is imperative that investors realize that what happens in Iraq is of critical importance to the entire world.

You can find the detail behind my opinion in two reports issued by the International Energy Agency (IEA). The IEA is the energy 'watchdog' for the developed world.

The reports I'm referring to are the IEA's 2012 World Energy Outlook and a special report released on October 9, 2012 called the Iraq Energy Outlook.

Before reading these reports I was very bullish on future oil prices. However, after reading I decided to dedicate even more of my investment portfolio towards crude oil producers.

In a nutshell, I became excited as an energy sector investor but terrified as an energy consumer. According to the 2012 IEA report, if Iraq takes its production from under 3 million barrels per day to more than 8 million barrels per day then oil prices in 2035 will be roughly $215 per barrel.

That got my attention. The projected price per barrel was $215, but only if they could nearly triple their production -- the keyword being if. I think the chances of Iraq taking production to those levels are miniscule at best.

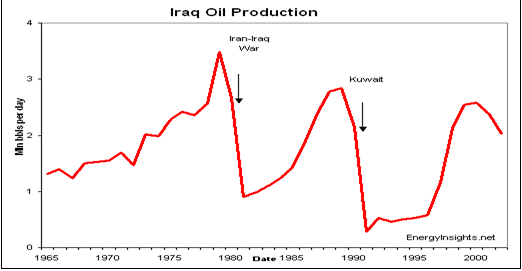

According to the IEA, Iraq alone was expected to provide no less than 45% of new oil production for the entire globe over the next twenty or so years. Historically, Iraq has never has production exceed 3.5 million barrels per day, and it has only been for short stretches that it has been able to do that.

Unless I missed a memo, Iraq hasn't been 'fixed.' There aren't enough grounds to claim that their oil production will become better -- much less 3x better.

I would still like to be invested in crude oil producers but would prefer if those companies were not in the Middle East.

Bankers Petroleum -- Attractively Priced Today With Huge Upside Possibilities

Bankers Petroleum (TSE: BNK) is an oil producer that operates exclusively in the country of Albania. Situated just above Greece and across from Italy, Albania provides a reasonably stable operating environment for Bankers and shareholders.

What attracted Bankers Petroleum to Albania was a unique opportunity called the Patos-Marinza oil field. This field is the single largest onshore oilfield in Europe and is estimated to contain a massive 5.4 billion barrels of oil in place.

To me, Bankers represents an excellent opportunity on three fronts:

- It is inexpensively valued relative to its cash flow and reserves

- It is growing at a fairly rapid and very predictable clip

- The huge amount of oil in place provides huge upside potential should technology continue to improve and allow for higher rates of recovery

I like to look at Bankers valuation from both a cash flow and reserve perspective.

Reserve Value

The most recent statement of reserves from Bankers independent reserve appraisal firms reports that Bankers has:

- 147 million barrels of proved reserves

- 232 million barrels of proved plus probable reserves

- Net present value (10% discount rate) of proved plus probable reserves after tax of $2.2 billion

Bankers has an after tax PV10 value of proved and probable reserves of $2.2 billion which equates to $9.72 per share. That is 42% above the current share price of $6.84. It is equally important to note that the PV10 value grows each year as the play is drilled up.

Multiple of Cash Flow

For the last 3 full fiscal years Bankers has generated cash flow from operations of the following amounts:

- 2010 - $71 million

- 2011 - $148 million (108% increase)

- 2012 - $193 million (30% increase)

- 2013 - $224 million (16% increase)

For 2014 that number is projected to be $300 million which is another 33% increase.

With an enterprise value of $1.7 billion that equates to a cash flow multiple on 2014's cash flow of 5.7 times. That isn't fall off of your chair cheap, but it's very attractive when you consider that the company has the ability to grow cash flow by 15% per year for many years to come.

The Big Upside Is From Improving Recoveries

Bankers currently has 232 million barrels of proved and probable reserves. That is only 4.3% of the original oil in place. Improving the recovery factor by just 1% would mean an additional 54 million barrels of reserves which is a 25% increase for Bankers.

Those recovery factor improvements are going to come from secondary recovery methods such as water and polymer flooding.

A water flood involves injecting water into a reservoir to increase pressures and force more oil out. A polymer flood involves injecting a gel into the water to make it thicker and push even more oil out.

Bankers cites the example of heavy oil secondary recovery success stories such as Cenovus (CVE) on its Pelican heavy oil field which has gone from 10% recovery under primary drilling to almost 20% with waterflooding.

Without any success with these secondary recovery efforts Bankers Petroleum is an inexpensive stock. With success, Bankers could be a big winner.

Actions to Take --> The stock market has had a great run and I believe we will get a chance to buy shares of most companies at better prices. Therefore, buy a small initial position in Bankers Petroleum and look to average down at better prices.

Risks to Consider: It is possible that the turmoil in Iraq and around the world sends oil prices considerably higher sooner rather than later. While I like the idea of waiting for a better price for oil producers, there is a chance that the upheaval in Iraq won't let that happen.