Federal income tax in America is considered a progressive tax, meaning that tax rates increase as incomes rise. The US government decides how much individuals owe in taxes by dividing it into income sections (also known as a tax bracket).

Federal income tax brackets are updated annually by the Internal Revenue Service (IRS). This is done to adjust for inflation and keep taxes appropriate to income.

Federal Income Tax Brackets and Rates

Your taxable income and filing status determine which tax bracket you fall into.

The top marginal tax rate stays at 37% for single-filing households (with incomes greater than $518,400). The table below lays out the federal income tax brackets for taxes due in April.

| Source | ||||

|---|---|---|---|---|

| Tax | Single | Married Filing Jointly | Married Filing Separately | Head of Household |

| 37% | $518,401+ | $622,051+ | $311,026+ | $518,401+ |

| 35% | $207,351-$518,400 | $414,701-$622,050 | $207,351-$311,025 | $207,351-$518,400 |

| 32% | $163,301-$207,350 | $326,601-$414,700 | $163,301-$207,350 | $163,301-$207,350 |

| 24% | $85,526-$163,300 | $171,051-$326,600 | $85,526-$163,300 | $85,501-$163,300 |

| 22% | $40,126-$85,525 | $80,251-$171,050 | $40,126-$85,525 | $53,701-$85,500 |

| 12% | $9,876-$40,125 | $19,751-$80,250 | $9,876-$40,125 | $14,101-$53,700 |

| 10% | $9,875 or less | $19,750 or less | $9,875 or less | $14,100 or less |

As you can see, those who make the least amount of money owe the lowest marginal tax rate. The more money one makes, the higher the tax rate.

How Do Tax Brackets Work?

Let’s break down the above table to further explain how tax brackets work.

Everyone is taxed in steps, not in one giant 24% chunk. For example, a single person earning $163,300 is not taxed 24% on that entire amount. Instead, they are taxed:

10% on the first $9,875 earned

12% for the portion up to $40,125

22% for the portion up to $85,525

24% for the portion up to $163,300

This clarification is important to dispel some misleading rumors. For example, if an employee earning $9,875 gets a $5 pay raise, then they would move to the next tax bracket. The next assumption is that this would decrease the total amount they take home due to a higher tax of 12%. However, the $9,875 is taxed at the same rate of 10% (and only the $5 raise will be taxed the higher 12%). This is what makes it a marginal (or incremental) tax.

For this reason, if you make over $9,875, you’d need to look at more than one bracket to calculate your tax rate.

How to Calculate Your Federal Income Tax Rate

Calculating your federal income tax rate can be a bit challenging. You first need to determine your Adjusted Gross Income (AGI). With your AGI, you can then determine your taxable income and find your bracket.

To figure out your Adjusted Gross Income, you can use Investing Answers’ adjusted gross income calculator. Then, subtract any deductions to arrive at your federal income tax rate.

Your taxable income and your filing status will then put you into a tax bracket.

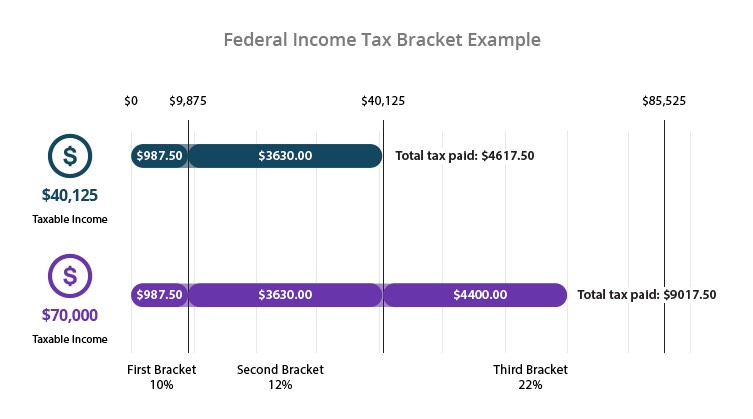

Federal Income Tax Bracket Example

Let’s do the math for someone whose taxable income is $40,125 per year and is filing as single.

This process repeats at every level of the tax brackets.

Marginal vs Effective Tax Rates

Tax brackets are broken up into sections, and each of these sections is a certain percentage between 10% and 37%. These numbers are the marginal tax rate. As mentioned earlier, you don’t pay the full marginal tax rate for the tax bracket you fall into: You only pay a portion of it as it relates to your income (like the example above).

How to Determine Your Effective Tax Rate

An effective tax rate is your average tax rate. You divide your total tax liability by your annual income.

Let’s look at the above example of effective tax rate:

Total Tax Liability $4618 (The IRS rounds up) / $40,125 = 11.5% Effective tax rate

This number only factors in federal income tax and does not include state and local taxes.

How to Get Into a Lower Tax Bracket

Moving into a lower tax bracket doesn’t mean you refuse your next raise. Instead, look for ways to reduce your taxable income through deductions. This means you pay less in taxes, which is always a good thing.

Common ‘above the line’ deductions that reduce taxable income regardless of whether you plan to take the standard deduction include:

Retirement Contributions - Your contributions to an employer's traditional 401k or a traditional IRA.

HSA Accounts - A Health Savings Account (HSA) is a tax-advantaged account created for individuals to use when paying for medical expenses. Contributions made to an HSA are tax deductible.

Student Loan Interest - The interest you paid towards your student loan debt can be deducted from your taxes (if you file an itemized return). This will lower your taxable income.

In certain cases, medical expenses, real estate interest, and work related expenses can also be deducted from your taxable income. If these are also deducted, then you will be filing an itemized tax return. The IRS has a complete list of tax deductions and credits for individuals.

If you have questions about your taxes, Investing Answers recommends that you consult a tax professional and the IRS website.