At the end of World War II, GIs had a little time to linger in Europe before heading home, and they embarked on the all-American pastime: shopping.

These soldiers found the U.S. dollar was so strong that small items like boxes of chocolate -- and big items like British motorcycles -- could be bought at shockingly low prices.

Fifty years later, U.S. consumers found out what happens when a super-strong currency loses its luster. The dollar no longer buys as much abroad as it once did, and a shopping spree in Paris or London will cost a lot of dough.

Of course, similar impacts have been felt in the investment world as well. The long-term fall in the dollar means U.S. companies can no longer snap up foreign rivals for a cheap price. But a falling dollar also means that any foreign assets that companies and investors own have risen in value. (Note that since the Great Recession of 2008, the greenback has firmed up a bit in what's known as a 'Flight to Quality,' but economists expect the dollar to weaken anew over the long-term.)

The question for many investors: How can I properly position my investment portfolio?

The prospect of a further fall in the dollar means it's crucial to make sure your portfolio has stakes in other economies. U.S. investors are now faced with hundreds of global investment options, and you should make sure that your portfolio has exposure to them.

For example, it's quite easy to buy shares of many foreign companies through what's known as ADRs, or American Depositary Receipts. These are U.S.-listed stocks that move in tandem with their equivalent shares in foreign markets. For example, shares of Germany's Daimler (Nasdaq: DDAIF), the parent company of Mercedes-Benz, trade here in the United States as well. There are now hundreds of ADRs available, and you can read more about them at ADR.com. If you want to get a better understanding of the pros and cons of foreign investing, the Securities & Exchange Commission (SEC) has a thorough discussion, which you can read about here.

An increasing number of U.S. investors are seeking to gain exposure to entire countries or regions through the use of exchange-traded funds (ETFs). There are many country-specific ETFs offered by Barclays as part of its iShares program, which you can read about here.

There are also international ETFs offered by firms like Global X Funds and Wisdom Tree. These firms tend to take a thematic approach, offering ETFs that provide exposure to certain types of companies (such as dividend-producing industrial stocks in Asia). If the dollar is indeed set to weaken anew, then you'll benefit by owning foreign investments as they will rise in value to the extent that the dollar loses value.

Why do economists think the dollar will weaken? There are several factors, but the most important one affecting currency moves is a country's trade balance.

Whenever a country runs a trade surplus (i.e. it exports more goods and services than it imports), its currency will strengthen as each country in a trade arrangement must buy or sell each other's currency to buy (or sell) goods. That helps explain why Japan's currency, the yen, has gained a great deal of value in the past few decades as the Japanese economy has consistently run trade surpluses. What's the net result of Japan's surging currency? The yen is now so strong that Japan's trade surpluses have vanished as its goods have become unaffordable to its trading partners. Simply put, Japan is no longer an export powerhouse precisely because its currency is now so much stronger.

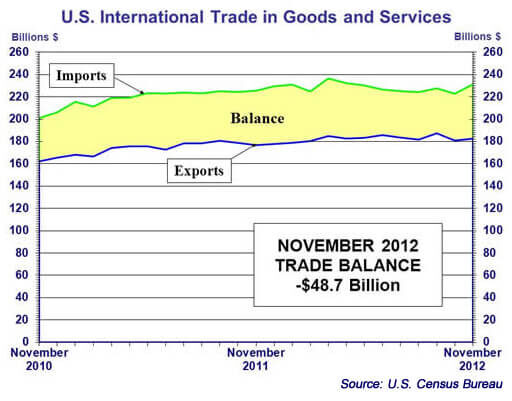

The United States, in contrast, has been running massive trade deficits (importing a much greater value of goods and services than it exports), which is why economists think the dollar will have to fall in value until the cost of doing business falls in the Unitd States and rises higher for countries that are running trade surpluses with us. In the short-term, other factors can prevent that from happening, but a look at currency trends over several centuries confirms the notion that trade balances are deeply interconnected with a country's currency.

Indeed, a weakening dollar could trigger a renaissance in U.S. manufacturing as the relative labor and overhead costs fall relative to other economies, which means that U.S. companies eventually will be a lot more competitive in foreign markets, while their foreign rivals will be less competitive in our markets.

The Investing Answer: Although the United States continues to rely heavily on imports, our exports are also rising at a solid clip. If current export growth rates continue, we eventually could wipe out our trade imbalance. Until then, the dollar is likely to weaken.

In response, you should hedge your portfolio by increasing your exposure to foreign companies and funds that are likely to increase in value as other countries' currencies strengthen. With so many new ways to invest abroad (thanks in large part to the increasing popularity of ETFs), you can easily find the right mix of assets to buy.