I figure that a good place to start looking for investment ideas is in the portfolios of the greatest investors in the world.

After all, imitation is the sincerest form of flattery. If these investing legends are buying something, chances are it's worth looking into.

Every quarter, I begin my search by reading the regulatory filings of my favorite investing gurus. By following their lead, I greatly reduce my error rate and save time looking for ideas.

Warren Buffett, arguably the greatest equity investor in the world, has continuously given me guidance. One of my favorite quotes from him is: 'I don't look to jump over 7-foot bars: I look around for 1-foot bars that I can step over.'

In other words, Buffett keeps it simple and looks for sure things. His painstaking attention to detail allows him to weed out the uncertainties and repeatedly select the big winners.

And Buffett has a strikingly concentrated portfolio. Even with over $120 billion of equities, Buffett keeps most of the money in shockingly few positions. So it's not easy for a company to earn a spot in the portfolio.

For example, at the end of December 2013, the Berkshire equity portfolio was worth $117 billion. The top positions were:

- Wells Fargo (NYSE: WFC) - $21.9 billion

- Coca-Cola (NYSE: KO) - $16.5 billion

- American Express (NYSE: AXP) - $13.7 billion

- IBM (NYSE: IBM) - $12.8 billion

As of December 31, 2012, Buffett's holdings in these four companies alone totaled $64.9 billion -- a whopping 55% of Berkshire Hathaway’s portfolio.

Most people are familiar with these “big four” stocks. But while combing through Buffett's latest purchases, I found an 'undiscovered blue chip' I'm pretty sure most investors know very little about.

In the second quarter of 2013, Buffett purchased 18 million shares -- worth more than $500 million -- of Suncor (NYSE: SU) for Berkshire Hathaway’s portfolio. Suncor is an integrated oil company with a massive presence in the Canadian oil sands.

I think Suncor is one of those “1-foot bars” that Buffett plans to step over. $500 million is a drop in the bucket for Buffett, but I'm guessing he'll stay true to form and add to his position over time.

It's easy to see why Buffett likes this stock.

The valuation of Suncor is very reasonable. Right now, it trades for just 6 times cash flow, which is roughly an average multiple for oil producers. But Suncor is not an average company.

You see, at current cash flow the market is not even pricing in any future growth. And Suncor has a resource base that will allow growth for decades upon decades. In short, Suncor's existing reserves could last for the next 100 years.

Let me explain…

In addition to the company's 7 billion barrels of proved and probable reserves, it has another 20 million barrels of contingent reserves that could move into the proved and probable category over time.

Today, Suncor produces approximately 550,000 barrels of oil per day. However, Suncor projects that it is on track to add another 300,000 barrels per day by 2020.

And technological improvements that expedite how quickly oil can be produced are always a possibility. That means Suncor's long-lived reserves could be extended even further than currently expected.

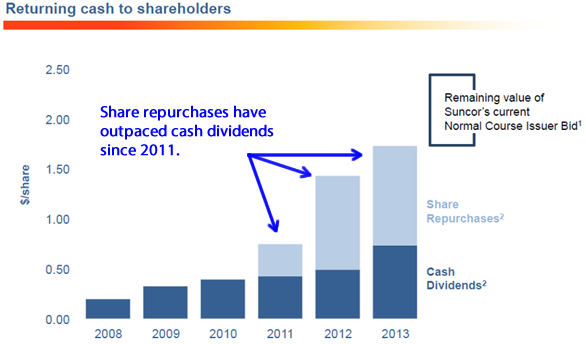

It's no surprise that, since 2008, the amount of capital the company returns to shareholders (through dividends plus share repurchases) has increased tenfold from $0.20 per share to $2.00 per share.

And judging by the company's recent actions, that annual distribution of capital to shareholders is likely to increase.

Suncor has tripled its dividend since 2008. And in 2011, the firm spent more on buybacks than it even paid out in dividends -- a number that only grew in 2012 and 2013, as you can see in the following chart.

Add to all this that Buffett just put his stamp of approval on the stock… and you have a very attractive investment.

It will be interesting to see if Buffett indeed keeps adding to his Suncor position in the coming quarters. At $500 million it isn't currently a major position for Berkshire -- but it could be.

Suncor is certainly a big enough company at a $60 billion market cap for Buffett to invest a few billion if he decides to.

Risks to Consider: Emerging technological innovations could arise and lower the demand for oil. Although it is unlikely, it is still possible.

Actions to take --> Follow Buffett and buy Suncor. What could be better than getting the stamp of approval from the greatest stock investor of all time and getting in at similar prices to what he paid.