The past few years have been a great time to be an investor.

Federal Reserve Chairman Ben Bernanke's zero interest rate policy has fueled large gains in just about every market sector since 2009.

There's little question that his policies are bullish in the short term, but what happens when the Fed's easy money stops?

In 1998, Mark McGwire set a record by hitting 70 home runs during the season, while Sammy Sosa hit 66. The previous record of 61 home runs had been set in 1961 by Roger Maris. In 2001, Barry Bonds broke McGwire's record by hitting 73 home runs.

At the time, baseball was an exciting sport to watch as home run records captured headlines. Later, fans learned that the hitters were abusing steroids. Home run outputs returned to normal after league-wide steroid testing became the norm in 2003.

Fed policy is acting like a performance-enhancing drug for the market. When it stops easing, I believe the markets will be unable to continue climbing at the frantic pace seen during the past year. Returns will be below average for some time, and stock selection will again become critical.

Personally, I'm not too worried about Fed easing ending. My stock selection process does not rely on a steroid-infused market.

Instead, I use a trading system that blends fundamental and technical analysis that not only tells me what to buy, but when to buy and sell.

It's been proven to work during bull markets, bear markets, wars, market bubbles and when inflation is high or low. You see, not only have I successfully used this system for years, but I've tested my stock-picking system going back decades.

Recently, I started using it to weed through the stock holdings of the 20 most prominent investors in the world and pick the best stocks from each of their individual portfolios -- investors like Warren Buffett, Carl Icahn, and David Einhorn.

This system -- which I call my 'Guru Trader' system -- has two profound benefits. First, each of these 'guru' investors has a team of analysts, money managers and traders to do their bidding. So when one of them picks a stock, you know it has been vetted by some of the greatest financial minds in the industry.

Second, this 'Guru Trader' system has the added advantage of reducing risk. My system pinpoints stocks with strong technicals, but only signals a buy if the underlying company has strong fundamentals.

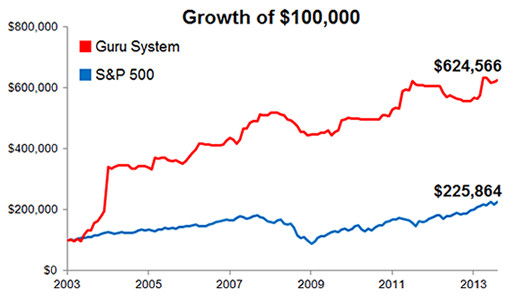

Take a look at how this system performed over the past 10 years in backtesting...

As you can see, my system has worked very well so far. Let me give you an example of a top-rated 'guru stock' my system highlighted -- Gastar Exploration (NYSE: GST).

On September 25, I alerted readers about an opportunity in Gastar Exploration, which produces oil and natural gas liquids from unconventional sources like the Marcellus Shale region in West Virginia. At the time, shares traded at about $4.16 with a dirt-cheap forward P/E ratio of 9.7.

Odds are you've never heard of this small-cap company. In fact, this company's tiny $256 million market cap let it fly under the radar of most institutional investors when my 'Guru Trader' system signaled 'buy.'

Shares are up 41% in less than 5 months, so far.

When my system signaled a 'buy' in GST, it was also a holding in Jim Simons' portfolio. Jim Simons may not be the most well-known hedge fund manager, but he is one of the best 'gurus' to follow, in my opinion.

He started his career as a mathematician and made important contributions to theoretical physics before becoming one of the first 'quants' on Wall Street. And although he charges some of the highest fees in the industry, he's generated a 35% a year return since 1989, after fees. That's enough to grow $10,000 to almost $15 million over the past 25 years.

But, like I mentioned, 'guru' ownership is just one of the criteria I look at when deciding what to recommend. The system I've perfected during my 26-year trading career is what actually decides what and when to buy and sell.

If you'd like to learn more about my 'Guru Trader' system and how to get my next trade in your inbox, we've put together a new report with plenty of information on how my system works. In it, I'll tell you how you can start using my system today to rack up gains of 42%... 60%... even 750% in just weeks or months. Click here to learn more now.

This article was first published by StreetAuthority under the title: This Simple System Leads To 41% Gains In Less Than 5 Months