In ten years, the most profitable oil sands development could very well be in the United States in the state of Utah.

The fact that oil sands even exists in the United States may come as a surprise to some.

Not only do they exist but these Utah oil sands companies are already promising to offer a competitive advantage against the Canadian version.

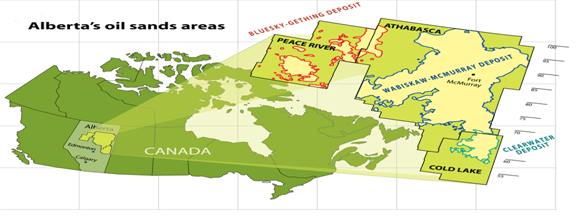

For example, one of the primary challenges of the Canadian oil sands is its location in the remote northern part of Alberta. It is extremely expensive to get supplies, equipment and people this far north. Likewise, Canadian operators have to pay hefty tolls in order to ship the oil down to the Gulf Coast refiners.

American Sands Energy (OTC: AMSE) is different. It is also an oil sand company, but it is located near Sunnyside Utah (150 miles southeast of Salt Lake City). They can simply load their oil production onto a train and ship it to one of six refineries that operate within the state.

The second advantage that American Sands Energy and its Utah peers have over the Canadian oil sands is that development in Utah is going to be much more environmentally friendly. Here's why.

The Utah deposits are extremely dry, meaning that oil development does not result in the production of water. This eliminates the need for tailings ponds. Simply put, tailing ponds are used as a container for residual oil that is left over after oil sands processing.

Tailing are ponds are quite the complication for the Canadian oil sands. They are expensive to maintain and hazardous to the environment and wildlife. Because Utah deposits do not require them, they are more environmental friendly and the water handling costs are reduced.

Furthermore, AMSE estimates that their energy costs could be as much as 60% lower than Canadian oil sands operations because they do not require expensive steam generating facilities.

Lower operating costs, reduced transportation costs, and more environmental friendliness are some significant advantages. But that's not all.

According to a third party report, AMSE controls an estimated resource of approximately 150 million barrels of recoverable bitumen.

In March of 2014, AMSE filed its application for an operating permit with the Utah Department of oil, gas and mining. Initial production from the Sunnyside location is planned at 5,000 barrels per day. But eventually, AMSE plans to take production up to 50,000 barrels per day from its existing resource base.

In addition to its existing 150 million barrel resource base, American Sands Energy has the potential to access another 950 million barrels on adjacent parcels of land. That's some significant growth potential.

This is the kind of leverage to barrels of oil in the ground that interests me. American Sands Energy is a small company, but it has the inside track on the development of almost a billion barrels of oil.

The initial plan for AMSE is to develop a 5,000 barrel per day mining operation. The total capital cost for this is expected to be $75 million which equates to a very attractive $15,000 per flowing barrel.

On that $80 WTI (current price is near of $100) American Sands Energy believes it can generate $40 million of EBITDA. At $100 WTI American Sands Energy's EBITDA would be closer to $65 million.

Assuming that all of the Series A preferred shares are converted into common, there are about 50 million shares outstanding (no net debt) which puts the enterprise value for AMSE at under $25 million.

That would mean that AMSE is trading at about one time the projected EBITDA (at $80 WTI) for 5,000 barrels per day of production. At $100 plus oil prices projected EBITDA the company would be trading for well under one time.

I believe a better metric today to assess value would be to compare the amount of oil American Sands Energy sits on relative to the price at which other barrels of oil sands resource have been sold at in an undeveloped state. That basically would give us a picture of what this oil is worth as it currently is.

Again, assuming the Series A Preferred shares convert to common, AMSE has an enterprise value of roughly $30 million. With 150 million barrels of identified oil sands resource that means that AMSE is trading at $30 million / 150 million = $0.20 per barrel.

The chart below compared the AMSE valuation with acquisitions of oil sands resource that had reached the permitting stage (like AMSE has). At the time the chart was prepared AMSE was trading at $0.40 per barrel and was already priced well under the norm.

Today the company trades at half that $0.40 per barrel valuation, and is valued at about one third the valuation of the average 'in-permitting' oil sands resource transactions that have occurred in recent years at around $0.60 per barrel.

It could actually be argued that AMSE's barrels should be valued at a premium given that the Utah Oil Sands have several advantages over Canada's oil sands. The most important advantage for valuation purposes being that the Utah Sands are expected to have a breakeven oil price of $45 per barrel which is half of what a new oil sands project needs.

If AMSE's production technique works as expected its oil in the ground should be revalued quickly to at least the $0.60 per barrel level that 'in-permitting' Canadian oil sands transactions have been occurring at.

However, keep in mind that American Sands Energy has yet to produce any oil, so all we have to base our projections on are the word of management to go on. Secondly, there is going to be some financing required between now and first production, so it is tough to model future cash flows without knowing the amount of dilution coming.

It is expected that in the coming months American Sands Energy is going to receive full approval from the state of Utah to commence commercial development. As we get nearer to the 'go live' date we could see shares of AMSE start to creep upwards as the market anticipates the big event.

The really big catalyst will be the market seeing some commercial levels of production from the company because at that point this goes from being a story to reality.

Actions to take --> Buy a few shares of AMSE so that you can keep your eye on it. If first production proves to be as profitable as the company has advertised you can then take a larger position in this company and still likely be well ahead of the rest of the market.

Risks to Consider: Although this company has great potential, it is still a higher risk micro-cap. Keep position sizes small until we see what a full commercial development can do.