My 2014 has sort of fallen out of the opening gate. I've been battling a tough case of the flu, something that they've always told me grows harder as one gets older, which sure seems true.

I refuse to let it get me too far down, though. This is a great time for investors to evaluate the past 12 months, review opportunities both exploited and missed, and look ahead to a fresh start.

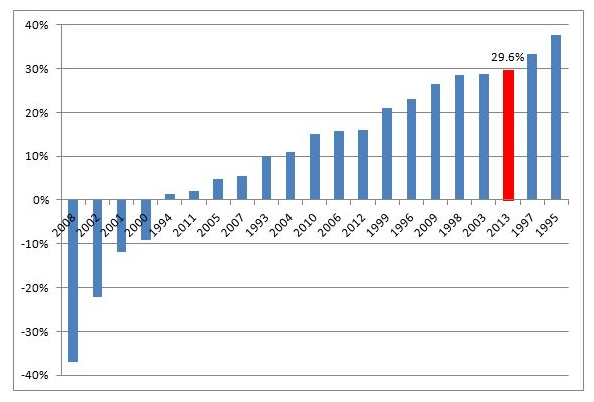

The S&P 500 has just wrapped up a strong year. Wall Street's benchmark average had price appreciation of 29.6%. Its total return, including reinvested dividends, was 32.4%, according to Bloomberg. That makes it the third-best year of the past two decades.

Interesting stuff. But as a great mind of our generation once posited, 'So what?'

Should we expect a gain of 24.3% or 31.2% in 2014? No one knows.

The fact is, we can expect, forecast or do a rain dance for whatever return we like. It doesn't matter. Some rational guesses can be made, but there are simply too many variables to say with any degree of certainty what the year is going to look like 365 days from now. We do know this much for sure, though: The year that will become 2014 will be nothing more than another value in an infinite series that averages about 9.5% on a compound annual basis.

The long-term data tell us the most important thing that any investor can know: Over time, the broader market is the best and most predictable wealth creation machine available at the least cost and with the lowest risk.

My advice: Invest at least 80% of your equity portfolio in the S&P 500.

You've likely heard me advocate this before.

But my role as Chief Investment Strategist of StreetAuthority's Game-Changing Stocks newsletter is to help you focus on the other 20% -- the kinds of stocks that are primed to change the baseline assumptions for an industry, potentially changing the way we live our lives -- and deliver triple-digit-plus growth potential in the process.

So today I'm going to do something I don't often do -- look back on a number of my previous picks and see how they have fared. Keep in mind, this is just a small sampling of picks I've brought to Game-Changing Stocks readers. There's a lot more we talk about, and they're not necessarily the ones I'm banking on to deliver a stellar 2014 (my latest research report, however, has details on 5 key trends that could do just that). That being said, some of these stocks still have room to run.

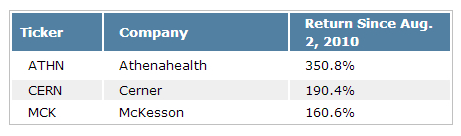

These three companies are leaders in the electronic medical records industry, which a lot of people didn't even know WAS an industry. But tucked into President Barack Obama's stimulus bill was a plan to bring medical records into the next century. All Medicare provider hospitals and clinics, which is just about everyone in the health care sector, have to have these systems in place by 2015 or they won't get paid. Pretty good motivation!

Most hospitals have jumped on the bandwagon with abandon, even though the cost of this software is pretty steep, estimated at $1,000 per licensed hospital bed. And every hospital in the country has to get with this program. It's huge business.

Cerner is the leader for large hospitals, and McKesson is a leading consultant for the top-tier crowd. Athenahealth is following the Wal-Mart model, focusing on the still very lucrative smaller markets that still have to comply but just can't afford a premium product from a Cerner. These companies will continue to see fat revenue as installs continue through 2015, and then they will move into even more lucrative service and upgrade businesses. Long-term owners of these shares are likely to see continued success with these stocks.

Tencent (OTC: TCEHY)

Return since first profiled on Oct. 25, 2012: 86.5%.

I initially profiled Tencent in Game-Changing Stocks while doing a comprehensive assessment of Chinese e-tail. Tencent, which offers gaming, e-commerce, social networking and chat, is the fourth-largest Internet company in the world, with a market cap of some $120 billion. The shares have done well and are at the upper end of their 52-week range. Investors have seen their best days and should look for greener pastures.

Kandi (Nasdaq: KNDI)

Return since first profiled on Dec. 20, 2010: 148.4%.

The battery-powered car industry looked like it was actually going to take off a couple of years ago. But the much vaunted Chevy Volt has failed to take off, and with it much of the hoopla for these cars has faded, even as the price of gasoline has hovered above the $3 mark for quite some time.

But while Tesla (Nasdaq: TSLA) may get all the attention for its production of sleek, high-end sports cars favored by the Hollywood 'in crowd,' Kandi is a Chinese carmaker with an everyman model. It's particularly notable because of its unique battery switch-out plan. When a driver's battery charge goes low, he or she pulls into a special energy station, and the battery is automatically changed for a fresh one. It's a slick system that solves the range problem and makes the cars useful for business owners.

Also worth noting, Kandi said its electric vehicle business is poised to outpace its legacy go-kart and ATV business. Leading the charge: Government support, which Kandi has always had and always banked on, which is the way of the world in China. Kandi has the potential to keep delivering.

Patience Is Key

I've chosen to highlight these particular picks for two reasons. The first is that I'm proud of them. They have been great performers for my Game-Changing Stocks readers. But the second reason is because they are from years past.

The fact is, this is investing on the edge. This is the next big thing. And the lesson I want everyone to latch onto is that it takes some time for most game-changers to gain traction. Game-changing investors should be hyper-rational, but also patient. These picks show how deep conviction can pay off.

I can't provide clearer proof that investing up to 20% of your portfolio in game-changing stocks is worth it than this.

The market this year did well enough on its own -- earning more than 30% on 80% of your money is nothing to sneeze at. But tossing some of these big winners into the mix changes everything. It makes the numbers much stronger.