As my last days in the military drew near, I was not concerned about money at all.

Unlike some of my colleagues, I had a good plan in mind on how to make money as a civilian. I had already been able to supplement my income while in service with a little known area of the stock market.

Once I 'got' what I'm about to share with you, a new income stream immediately started supplementing my military income by 10% -- while in the middle of a war zone with very limited time and enormous stress.

As soon as I left the military, I not only replaced my income, but I exceeded it by 30%. And both my income and net worth continue to grow to this day, thanks to this often misunderstood area of the market.

I don't want to beat around the bush or make this sound like some super-secret investing strategy only I can tell you about. I am talking about selling options.

Now, before you decide that you never want to try options trading, let me show you what a recent subscriber to my Income Trader newsletter had to say about this strategy:

'When I first started using [Amber's] picks, my goal was to earn $500. Then I quickly realized I can earn at least $1,000 per month. I use the profits to buy more... Not only are your picks excellent with low risk, it teaches you to look for other options on your own, which I have done.'

--Nathan S., West Long Branch

I know you're probably thinking that to be able to make that much money a month, there must be enormous risk involved. That actually couldn't be further from the truth.

While it is a fact that 80% to 90% of options buyers lose money, there's a flip side... It means that 80% to 90% of options sellers make money. And that's where I like to focus.

As you may already know, 'put' options give buyers the right -- but not the obligation -- to sell a stock at a specified price before a specified date.

When we sell a put contract, we receive cash, or what I call 'Instant Income,' upfront.

Selling a put means we're expecting the stock not to fall to a certain price. If it does, for every contract we agree to, we have to buy 100 shares at that price (more on why that's not a bad thing in a minute).

If the stock goes up, or doesn't sink to the price we specified, we pocket that upfront money as pure profit.

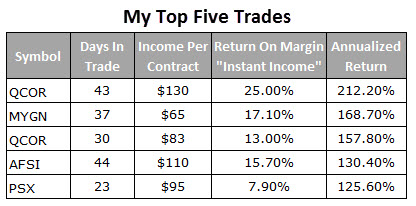

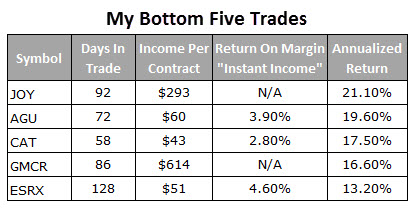

All 52 of my recommended trades have made gains so far this year. Take a look at how much income my top five and bottom five closed trades have generated so far in my Income Trader newsletter:

Every trade has been a winner. While our top trades really blew it out of the water, even the trades that didn't still produced annualized returns between 13.2% and 21.1%.

On average, we've generated 7.4% in Instant Income over 56 days -- an average annualized gain of 48.2%.

If you were to just sell one contract for each recommended trade, you would have pocketed a total of $4,510 in Instant Income since the service launched just sixteen months ago. And that's fully scalable -- if you had sold 10 contracts of each recommended trade, you would have amassed a cool$45,100 in Instant Income.

So what's the downside risk? As my colleague Bob Bogda explained in a previous StreetAuthority Dailyissue, you can end up buying shares of the underlying stock if they fall below the strike price.

For example, let's say a stock falls 12% in a single day on news of a Securities and Exchange Commission investigation. Assuming shares fall below the option's strike price, investors that sold puts might be required to buy the stock for more than its current price.

But, my strategy has an answer to that potential problem...

My risk analysis goes deeper -- and into the companies themselves. I always make sure that we are selling options on stocks we wouldn't mind having in our portfolios.

When this happens, you get the opportunity to buy shares of a company you want to own anyway -- just at a lower price than the market was offering when you sold the put. You'll even know the price upfront before you enter the trade.

Of course, this does not happen often. In my experience, more than 85% of options expire worthless, meaning we don't have to buy shares, and the Instant Income we receive when selling puts is pure profit.