What is a Descending Triangle?

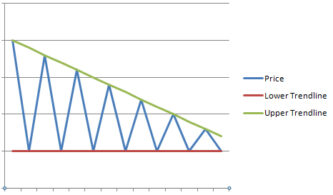

The descending triangle is a pattern observed in technical analysis. It is the bearish counterpart of the bullish ascending triangle pattern. The trendline connecting peak price levels should be downward sloping toward the horizontal trendline connecting the low price levels.

How Does a Descending Triangle Work?

If the upper trendline intersects the lower trendline, technicians expect downside momentum of the stock to grow stronger. The bottom trendline is also known as support.

Why Does a Descending Triangle Matter?

Many investors are skeptical of technical analysis and the traders who use it to make short-term profits, but the fact that so many traders observe these trends has caused them to have somewhat of a self-fulfilling effect. For this reason, a large proportion of traders take technical analysis into consideration when making investment decisions.