News stories over the past few years have focused on tariffs and rumors of “escalated trade wars” between the United States and another country. But what is a tariff? Are they taxes on all imported goods? Do they ultimately get passed down to the consumer? Here’s everything you need to know about tariffs.

What Is a Tariff?

In the simplest terms, an international tariff is a sovereign government tax on imported goods or services from another country. Often used as a political tool, tariffs are installed to discourage companies or consumers from buying imported goods or services from certain countries or trade blocs. Instead, these are sourced from within the nation instead.

Tariffs can also discourage the import of certain items in order to encourage domestic production. By imposing additional fees on imports, governments can force the hands of producers to hire workers and ramp up internal production.

The History of International Tariffs

When the founding fathers wrote the United States Constitution, the power of setting tariffs, duties, imposts, and excises on imported products was placed on Congress. But since World War I, several laws passed by Congress have passed many of those responsibilities to the executive branch.

Three specific laws – the Trading with the Enemy Act of 1917, the Trade Act of 1974, and the International Emergency Economic Powers Act passed in 1977 – allow Presidents to impose tariffs during national emergencies or in situations where the nation would experience “an adverse impact on national security from imports.”

Types of Tariffs

Although they can be created for any reason, there are four primary motivations for adding international tariffs in trade. They can range from protecting a country’s labor markets to discouraging trade with certain countries.

Specific Tariffs

When tariffs are levied as a fixed charge to certain products entering a country, it is called a “specific tariff.” Each of these tariffs are levied against individual product categories, and cost a flat fee per import. For example, according to the World Bank, the United States charged a specific tariff of $0.68 per live goat imported into the country in 2010.

Protective Tariff

Protective tariffs are imposed on items seen as a potential threat to items produced within a nation. One protective tariff example is the China Section 301 tariffs imposed in 2018. In order to encourage more steel production in the United States, a protective tariff was applied to steel imports.

Ad Valorem Tariffs

The Latin term “ad valorem” roughly translates to “according to value.” Accordingly, an ad valorem tariff is an import tax directly tied to the value of the items. If a government sets this type of international tariff to an item, customs officials will collect a tax directly tied to the product’s value.

Compound Tariffs

Compound tariffs are a mix of both specific tariffs and ad valorem tariffs. When a government sets an international compound tariff on a product, the taxes are a combination of a fixed price per item, as well as a percentage of the individual or total import’s value.

How Does a Tariff Work?

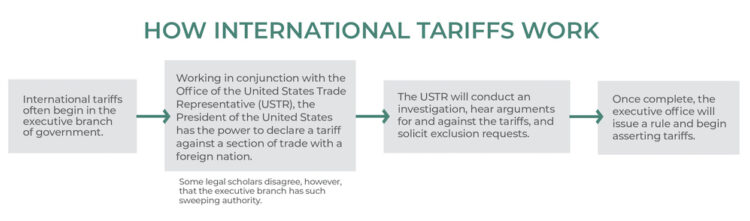

In modern America, international tariffs often begin in the executive branch of government. Working in conjunction with the Office of the United States Trade Representative (USTR), the President of the United States has the power to declare a tariff on trade with a foreign nation. Some legal scholars disagree, however, that the executive branch has such sweeping authority.

From there, the USTR will conduct an investigation, hear arguments for and against the tariffs, and solicit exclusion requests. Once complete, the executive office will issue a rule and begin imposing tariffs.

Example of an International Tariff

Starting in 2018, the USTR began enforcing a number of tariffs against China. This came after an investigation defined under Section 301 of the 1974 Trade Act that included certain drilling, boring, and milling machines, as well as hand tools, ball bearings, studio-grade television cameras, and printed circuit assemblies for radio and television equipment.

Are Tariffs and Duties the Same?

Although they are often collected at the time of import, tariffs and duties are not the same thing. Tariffs are direct taxes collected by US Customs and Border Protection (CBP), as defined by the Harmonized Tariff System Codes (HTS) book. The HTS codes inform CBP which items – and from where – have active tariffs. This allows taxes to be collected from the importers.

Duties are collected as an indirect tax on people or companies bringing items into the United States. Under federal law, individuals entering the United States have a duty allowance based on their citizenship and the items they are bringing back.

Example of a Tariff

As an example of a tariff: A company importing 10,000 printed circuit assemblies from China would declare their items under HTS 8529.90.09. CBP officers would charge the importer a tariff per item imported.

Example of a Duty

An American brings back $200 of goods from a weekend in Canada, including two liters of liquor. Under their personal allowance, their first liter would be duty-free while the second one would be charged a flat duty rate of 3%, plus internal revenue tax due (where applicable).

Tariffs vs. Quotas

Unlike an international tariff, trade quotas are a limit on any certain type of imported item to the United States. Quotas are set by state and federal governments, and once they are met, all other similar items are blocked from import.

Simply put: Tariffs are taxes while quotas are limits. Tariffed items can be imported as long as the taxes are paid, while quotas block imports once the limit is met.

Tariffs vs. Free Trade

Tariffs are a limitation on free trade. While free trade zones abolish tariffs on items between countries, tariffs add additional taxes to imports under certain categories.

For example, the North American Free Trade Agreement (NAFTA) set a “free trade” zone between the United States, Canada, and Mexico. Companies could import and export certain items between the three nations without paying taxes. Compared to free trade, tariffs add a tax to importing certain items from one country to another.

Where Do Collected Tariffs Go?

In the United States, international tariffs are collected by CBP and paid by importers. In 2019, CBP collected over $52.9 billion in tariffs on imports. These taxes are deposited into the US Treasury and ultimately become part of the federal government’s general budget.

How Tariffs Are Calculated

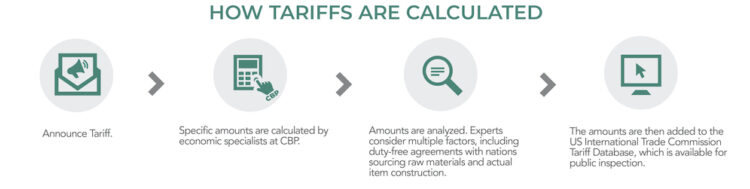

Once a tariff is announced, the specific amount is calculated by economic specialists at CBP, who then analyze each of the affected items. These experts consider multiple factors of each item, including duty-free agreements with nations sourcing raw materials and actual item construction. The amounts are then added to the US International Trade Commission Tariff Database, which is available for public inspection.

How Tariffs Affect Prices

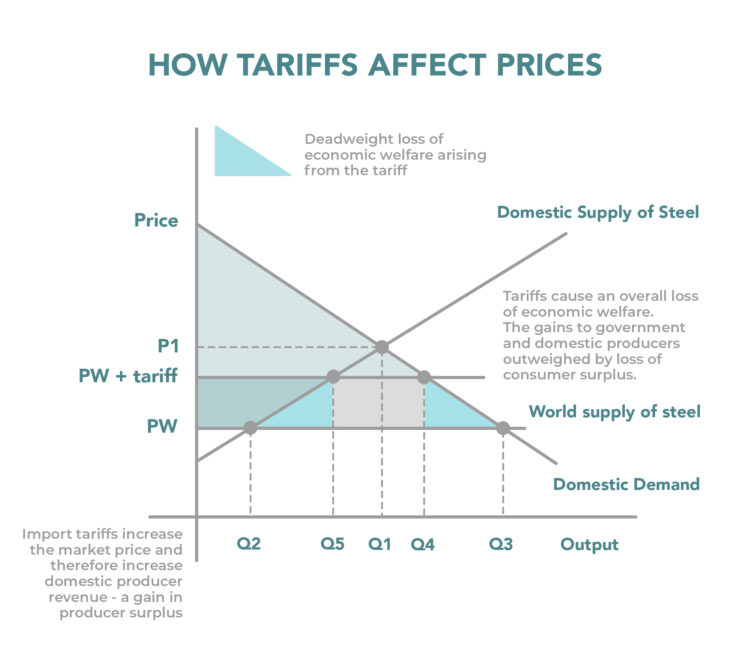

When cheaper items produced in other countries are imported, they have the potential to undercut prices of domestic-made items. In turn, the lack of sales can create a ripple effect affecting companies, and ultimately jobs. Tariffs are designed to protect prices of items produced domestically, by assessing additional import fees on lower cost products. If applied correctly, tariffs are designed to drive up prices to market norms, giving imported items less of a price advantage over domestically-produced items in the same category.

How Tariffs Affect Consumers

While international tariffs are paid by importers, costs are usually handed down to the consumer in the form of higher prices. An example of tariffs affecting consumers can be found in the automotive world. American car importers pay a 2.5% tariff on every auto brought in from Japan. As a result, car dealers often increase their car prices by 2.5% or more to offset the import taxes.

Can Tariffs Be Written off on Taxes?

According to the Internal Revenue Service (IRS), there are certain situations where individuals and companies may qualify for a foreign tax credit. However, import tariffs do not qualify since the credit is only available for foreign taxes paid through offshore corporations. Tariffs do not count under that distribution.

Can Tariffs Cause a Recession?

There are conflicting opinions on how international tariffs contribute to a recession. While many economists and scholars agree it can be a contributing factor, it may not be the only consideration.

During the first round of China 301 Tariffs, economists from Morgan Stanley and Goldman Sachs warned that increased tensions and a trade war could depress corporate earnings. In turn, the analysts warned job growth could stall and spending could slow.

As the tariffs continued, aggravating factors (especially the COVID-19 pandemic) began creating complications for exports. At the beginning of the pandemic, imports from China and other Asian nations decreased nearly by half. This was due in part to lockdows caused by the novel Coronavirus outbreak, and in part to increased tariffs.

Simply put: International tariffs are a mitigating factor in a recession, but they aren’t the sole cause on their own.

Did Tariffs Cause the Great Depression?

Over the past 90 years, economists have studied the Great Depression from every angle. Although tariffs did not start the Great Depression, they may have accelerated problems for the country.

After the Stock Market Crash of 1929, President Herbert Hoover decided the best way to protect American farmers was through adding international tariffs on imports from every US trade partner. Working through Congress, the Smoot-Hawley Tariff Act added taxes on numerous inbound goods. In response, countries issued their own trade restrictions, immediately hurting US exports and an already fragile stock market. It wasn’t until 1934 that America rescinded on their tariff policies, starting with the Reciprocal Trade Act.

Recent Tariff News

Over the last four years, the most recent international tariff news has focused on China and the European Union. The most talked about is the China Section 301 Tariff Actions and Exclusion Process. Through four phases, the United States has taken over $300 billion in trade actions against China. The executive branch of government has also taken action against the European Union for alleged subsidies in the large civil aircraft industry. As a result, several products imported from the trade bloc were assessed additional tariffs, including dairy products, olive oil, precision tools, and clothing items. As of the time of writing, the USTR is currently investigating digital services taxes for potential tariffs.