Quick Ratio Definition

The quick ratio (also known as the acid-test ratio) offers insight into how well a company can meet its short-term obligations. As in chemistry, an acid test provides fast results, showing how quickly a company can convert short term assets to pay short term liabilities. Essentially, it’s a measure of company liquidity.

What Is a Good Quick Ratio?

Once you calculate the quick ratio, you can determine if:

A company is able to meet its short-term obligations by converting its short-term assets into cash.

A company is able to meet its obligations without selling off inventory.

A company is over-leveraged.

The quick ratio represents the amount of short-term marketable assets available to cover short-term liabilities, and a good quick ratio is 1 or higher. The greater this number, the more liquid assets a company has to cover its short-term obligations and debts.

A number less than 1 might indicate that a company doesn’t have enough liquid assets to cover its current liabilities.

Quick Ratio Formula

There are two ways to calculate the quick ratio:

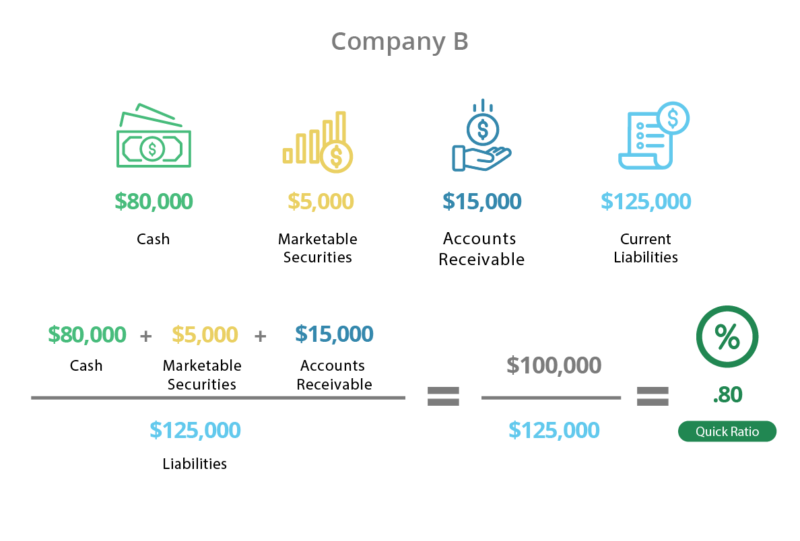

Quick Ratio Formula 1

Cash + Marketable Securities + Accounts Receivable

Current liabilities

OR

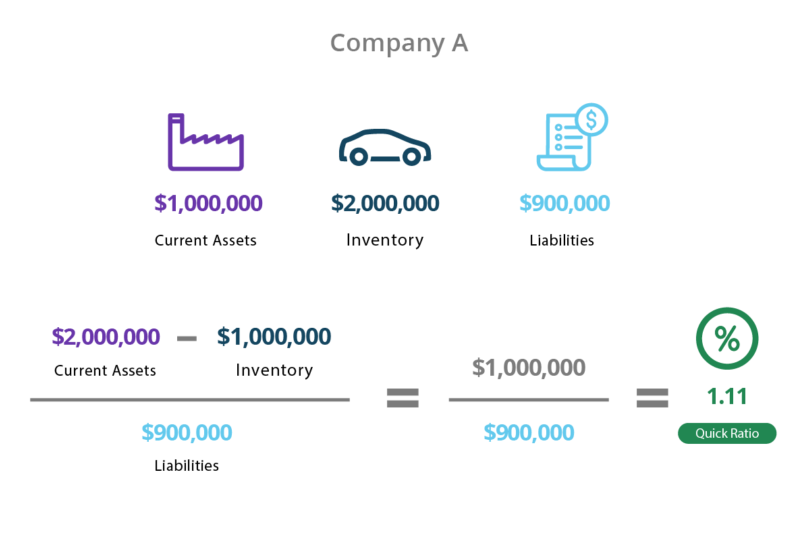

Quick Ratio Formula 2

Current assets - inventory

Current liabilities

Formula 1 includes only the most liquid current assets. Formula 2 counts all assets except inventory as liquid. Some (such as prepaid expenses) may not actually be able to be turned into cash to cover liabilities, however.

Why Isn’t Inventory Included in the Quick Ratio Formula?

The quick ratio doesn’t include inventory because it’s not a liquid asset (or an asset that can be quickly and easily converted into cash). Inventory turnover takes considerable time and effort. It cannot be converted into cash as quickly as, say, marketable securities or accounts receivable.

How to Calculate the Quick Ratio

First, look at a company’s balance sheet and locate the numbers listed for cash on hand, marketable securities, accounts receivable, and current liabilities. Add these assets to find the numerator, then use the number on the balance sheet for current liabilities as the denominator. Divide to find the quick ratio.

Or, simply use the total of current assets and subtract inventory to find the numerator. Then use the number on the balance sheet for current liabilities as the denominator.

Pros and Cons of Quick Ratio

The advantage of using the quick ratio is that it is a highly conservative figure.

The quick ratio is also an easy number to calculate for almost any company. If you have a balance sheet available, it’s easy to plug the numbers into the formula and find this number within seconds.

On the other hand, quick ratios don’t take into account the fact that a company – particularly during an economic downturn – may have difficulty collecting its receivables.

Limitations of Quick Ratio

Despite it being both an easy and popular metric to assess a company’s current financial health, there are limitations to quick ratio analysis.

Can Only Compare Ratios within an Industry

When using the quick ratio to make comparisons between companies, it’s important to compare ratios among companies in the same industry – not across industries. This is because certain industries may have longer credit collection cycles than others, thus impacting accounts receivable, for example.

The quick ratio is an easy and fast calculation that provides useful insight into a company’s ability to pay its short-term obligations. It’s important to remember, however, that more detailed calculations will need to be made to accurately assess a company’s financial health.