What Is Strike Price?

Strike price, also referred to as “exercise price,” is the specific price at which an investor can exercise an option to buy or sell an option contract’s underlying security, such as stocks, bonds, and commodities.

What Is the Strike Price in Options Trading?

The strike price of an option is a fixed dollar amount that stays the same during the entire option contract term. To understand what strike price means in options trading, it’s helpful to start with an introduction to the option contract.

What Is an Option Contract?

An option is a type of derivative (or a financial contract) that derives its value from an underlying asset. In the case of an option contract, the asset is often a security (such as a stock) but options can be written for anything.

The option contract sets the strike price for the underlying security. It also states how many shares an option holder can buy or sell, though 100 is the typical number. In the US, option contracts come with expiration dates that serve as the deadline for the investor to exercise their option (to buy or sell at the strike price).

Who Sets the Strike Price?

Strike prices are set by options exchanges such as the American Stock Exchange, the New York Stock Exchange, and the Chicago Board of Options Exchange.

Why Does Strike Price Matter?

The strike price matters because it’s a major determining factor in the value of the option. More specifically, the relationship between strike price and the underlying security’s market value is what determines how much intrinsic value an option has. An option has intrinsic value if it can be exercised at a profit, that is, if the underlying security can be bought or sold at the strike price to earn a profit.

How Does Strike Price Work?

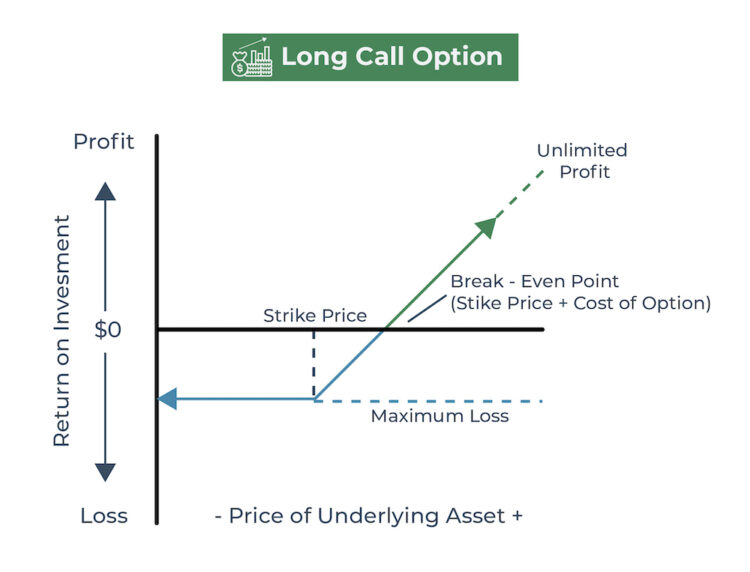

Option strike prices make the option profitable depending on whether the actual, current price of the security is greater than the strike (for a call option) or less than the strike (for a put option).

Strike Price for Call Options

A call option gives the investor the option to buy the security at the strike price before the contract expires. For example, if the strike price for the security is $50 – but the stock is trading for $100 – the investor can buy it for $50 by exercising the option.

Before the contract expires, the investor can profit by purchasing the security at the strike price and selling it at a profit, or by selling the call option itself at a profit.

Strike Price for Put Options

A put option gives the investor the option of selling the security at the strike price until the contract expires, regardless of how much the security is trading for on the open market. If the security’s strike price is $50 – but the security is trading for just $25 on the open market – the investor can sell the security for $50 by exercising the option.

The investor can profit from the put option by selling the security for more than its market price – or by selling the option for more than they paid for it – before the contract expires.

How Is Strike Price Calculated?

Strike prices are based on the underlying security’s spot price, which is the price it closed at the previous day (as well as factors like trading volume and volatility). The exchanges make several strike price options available to cover a range set at fixed intervals (e.g. $2.50, $5).

For example, an exchange might make five options available with Company ABC stock as the underlying security. Assume the stock is trading at $100, and the exchange wants to use $2.50 intervals for the strike prices. It might set the strike prices thusly:

Option 1: $95.00

Option 2: $97.50

Option 3: $100.00 (which is also the current market price)

Option 4: $102.50

Option 5: $105.00

Investors can now select from a range of strike prices and choose the one(s) most aligned with their goals for the investment and their expectations for the stock’s future price.

Strike Price and Moneyness

“Moneyness” refers to the relationship between the strike price and the market price of the option’s underlying asset. The three types of moneyness are:

- “in the money (ITM)”

- “at the money” (ie. break even point) and

- “out of the money” (OTM)

These define whether the option contract has intrinsic value, which is the difference between the price of the underlying security and the strike price.

“In the Money” Option Contracts

An option contract is “in the money” when it has intrinsic value. In the case of a call option with stock as the underlying security, that means the stock’s strike price is less than the stock’s market price. This lets the investor buy at a discount and earn a profit when they sell the stock at the going rate.

A put option is “in the money” when the security market price is less than the strike price, letting the investor sell the security for more than it’s worth.

Strike Price and “At-The-Money”: Break Even

An option’s break even point occurs when the security’s market value equals the strike price plus (for a call option) or minus (for a put option) the option contract premium you pay for each share bought or sold.

For example, If you have a call option contract that lets you buy or sell for a strike price of $100 – and your premium is $1 per share – your break even is $101. You would break even when the security’s market value is at least $101.

Strike Price and “Out of the Money” Option Contracts

An option contract is “out of the money” when it has no intrinsic value. A call option is “out of the money” when the strike price is higher than the value of the underlying security. A put option is “out of the money” when the strike price is less than the value of the underlying security.

When an Option Contract Expires “Worthless”

When an option is “out of the money”, the investor doesn’t exercise the option because there’s no profit to be made. The contract will expire worthless. The investor loses the amount they paid for the option contract if they don’t exercise it, but their loss is limited to that amount.

Strike Price Examples

To see how strike prices work in practice, let’s look at two hypothetical option contracts for Company ABC, one with a favorable strike price on a call option and one with a favorable strike price on a put option.

Note: Assume the contract gives the investor the right to buy or sell 100 shares of Company ABC stock before the contract expires. Remember, the investor will only exercise the option if the option is in the money or at the money (break even).

Strike Price Example 1: Exercising a Put Option

For this example, a hypothetical put option contract has Company ABC stock as its underlying security. The contract calls for the following:

| Number of shares that can be sold | 100 |

|---|---|

| Option premium (cost) | $1 |

| Strike price | $55 |

| Stock price (market price) | $50 |

First, calculate the price of the option contract: 100 shares x $1 = $100.

Next, calculate the option’s break-even price: $55 strike price minus $1 premium = $54

In this strike price example, the put option is “in the money” because the security price is currently lower than the break-even price. The investor would profit by exercising the put option and selling stock worth $50 per share for the $55 strike price.

Breaking This Down:

- Subtract the market price from the strike: $55 ) - $50 = $5 profit per share

- $5 x 100 shares = $500 gross profit

- Subtract the premium: $500 - $100 , and the net profit is $400.

Strike Price Example 2: Exercising a Call Option

This example looks at a hypothetical call option that has Company ABC stock as its underlying secure. It makes the following assumptions:

| Number of shares that can be sold | 100 |

| Option premium (cost) | $1 |

| Strike price | $55 |

| Stock price (market price) | $60 |

First, calculate the price of the option contract: 100 shares x $1 = $100.

Next, calculate the option’s break-even price: $55 strike price plus $1 premium = $56

Because the security price is currently higher than the break-even price, a call option would be “in the money.” That’s because the investor would profit by purchasing stock worth $60 per share for the strike price of just $55 per share.

Breaking This Down

If the investor exercised the option and immediately resold the security shares at market price:

- Subtract the strike from the market price: $60 - $55 = $5 profit per share

- $5 x 100 shares = $500 gross profit

- Subtract the premium: $500 -$100, and the net profit is $400.

How to Pick a Strike Price

Because the strike price has a major impact on the value of an option contract, it’s important to make decisions carefully. Your decision should be based on what you think the underlying security’s market price will do between the time you purchase the option and the option’s expiration date. You should also consider the price of the contract itself (ie. how much you hope to buy or sell it for).

How To Choose Strike Price for Call Options

The first step in choosing a strike price for call options is to research the price of the underlying security.

If you are buying a call, you want the stock price to end up greater than the strike. This means you typically buy a call if:

- The strike is near market now and you think the stock price will rise.

- Or, the strike is greater than the current price and you think the stock price will rise a lot and end up greater than the strike.

If the strike is less than the market price when you buy the call, the call will be expensive, making it harder to realize a profit.

The wider the gap between the security price and the strike price, the ‘safer’ your investment. That’s because the security price would have to drastically decrease before it met or dipped below the strike price. Once it dips below the strike price, the potential profit on the call option position is wiped out.

How To Choose Strike Price for Put Options

Because the goal of a put option is to sell the underlying security for more than it’s worth, look for a strike price that’s close to market if you think the stock price will decrease, and with a strike below market if you think the stock price will decrease a lot.

What To Remember About Strike Prices

Strike prices determine whether the investor loses the money they invest in the options contract. or profits by a favorable spread between the strike price and the security price. It’s a gamble that requires weighing the probability that the security price will move in the anticipated direction.

Risk Tolerance

Risk tolerance is the amount of risk an investor is willing to accept when they invest their money. An investor with low risk tolerance probably shouldn't invest in options at all. That said, if you are interested in a options contract with ‘lower’ risk (i.e. lower risk when it comes to options) this means you will look for:

- For a call option, that might mean a security price that’s much higher than the strike price.

- For a put option, it might mean a security price that’s much lower than the strike price.

Risk-Reward Payoff

Generally speaking, option contracts with greater risk cost less than less risky options. However, the high-risk option is likely to pay more. So although the investor has a greater chance of losing money in the event they can’t exercise the option, they also stand to earn a larger profit if the option can be exercised.