What Is Margin?

Margin can be defined in two main ways:

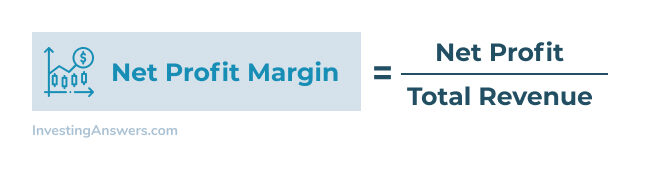

- It is the ratio of profit divided by revenue. This financial ratio is used to determine a company’s profitability.

- Money borrowed from a brokerage firm in order to leverage an investment.

Why Margins Matter

Quite simply, margins measure efficiency. The higher the operating margin, the more profitable a company's core business is per dollar.

It’s important to note that some industries have higher labor or material costs than others. This is why comparing operating margins is generally most meaningful among companies within the same industry. The definition of a 'high' or 'low' ratio should be made within this context.

What Can Affect Margins?

Several things can affect operating margin (e.g. pricing strategy, prices for raw materials, labor costs). But because these items directly relate to managers’ day-to-day decisions, operating margin is also a measure of managerial flexibility and competency.

Margin Examples

As with most financial definitions, it’s easier to understand both types of margins with examples.

Margin as a Financial Ratio Example

Company XYZ records $1 million in net income for 2008 and $10 million in sales. We can calculate Company XYZ’s margin by dividing profit by revenue.

The company has a $1,000,000/$10,000,000 = 10% profit margin.

It is safe to assume that Company XYZ keeps 10% of the revenue it generates (ie. for every $1 XYZ generates in revenue, it keeps $0.10 in profit).

Borrowing Money on Margin

Let's assume you have $2,500 and Company ABC trades at $5 a share. In a regular brokerage account, you’d be able to purchase 500 shares. If this company were to appreciate by $10, you’d make $5,000 and earn a respectable 200% gain.

But with a margin account, you could essentially borrow money from the brokerage firm and collateralize the loan using Company ABC shares. Margin requirements for equities are normally 2-to-1 for the average investor, meaning you’ll purchase double your cash balance.

An investor with a margin account would be able to purchase $5,000 of Company XYZ (or 1,000 shares). That same $10 price move would mean you’d then make $10,000 and earn a 300% return.

Gains & Losses Work Both Ways

Margin is a double-edged sword which means that losses are also magnified. Additionally, if investor equity in the account drops past a certain point (e.g. 25% of the total purchase amount), the brokerage firm may make a margin call. That means within a few days, you’ll need to deposit more cash or sell some of the shares to offset all/part of the difference between the actual stock price and the maintenance margin.

Margin accounts allow investors to make investments with their brokers' money. In some cases, a brokerage firm can sell an investor's securities without notification – or even sue if the investor does not fulfill a margin call. For these reasons, margin accounts are generally for more sophisticated investors who understand and can handle the risks involved.