What is Days Working Capital?

Days working capital is the ratio of working capital to sales. The formula is:

Days Working Capital = (Average Working Capital x 365)/Annual Sales

How Does Days Working Capital Work?

Working capital is money available to a company for day-to-day operations.

The formula for working capital is:

Current Assets - Current Liabilities

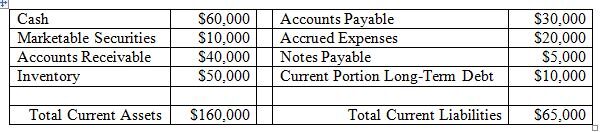

Here is some balance sheet information about XYZ Company, which had $25 million in revenue for the year:

Using the working capital formula and the information above, we can calculate that XYZ Company’s working capital is:

$160,000 - $65,000 = $95,000

Remember, the balance sheet is a snapshot of where things stand on the last day of the accounting period, so we need to multiply this $95,000 by 365 days.

Using this information and the formula above, we can calculate that Company XYZ's days working capital is:

Days Working Capital: ($95,000 x 365)/$25,000,000 = 1.387

Thus, we can say that Company XYZ only has about a day and a half worth of working capital available.

Why Does Days Working Capital Matter?

Working capital is a common measure of a company’s liquidity, efficiency and overall health. Because it includes cash, inventory, accounts receivable, accounts payable, the portion of debt due within one year, and other short-term accounts, a company’s working capital reflects the results of a host of company activities, including inventory management, debt management, revenue collection and payments to suppliers.

Analysts are sensitive to decreases in days working capital; they generally suggest a company is becoming overleveraged, is struggling to maintain or grow sales, is paying bills too quickly, or is collecting receivables too slowly. Increases in days working capital, on the other hand, generally suggest a company is possibly underleveraged, is experiencing high sales growth, is paying bills too slowly, or is collecting receivables quickly.

When not managed carefully, businesses can grow themselves out of cash by needing more working capital to fulfill expansion plans than they can generate in their current state. This usually occurs when a company has used cash to pay for everything, rather than seeking financing that would smooth out the payments and make cash available for other uses. As a result, days working capital shrinkage can cause many businesses to fail even though they may actually turn a profit. The most efficient companies invest excess working capital wisely to avoid these situations.

It is also important to understand that the timing of asset purchases, payment and collection policies, the likelihood that a company will write off some past-due receivables, and even capital-raising efforts can generate different days working capital expectations for similar companies. Equally important is that days working capital needs vary from industry to industry, especially considering how different industries depend on expensive equipment, use different revenue accounting methods, and approach other industry-specific matters. For these reasons, comparison of days working capital is generally most meaningful among companies within the same industry, and the definition of a 'high' or 'low' ratio should be made within this context.