What is a Common-Size Income Statement?

A common-size income statement is an income statement in which each line item is expressed as a percentage of sales.

How Does a Common-Size Income Statement Work?

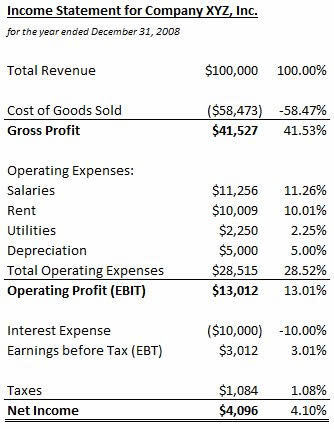

For example, let's assume that Company XYZ’s income statement looks like this:

The right side of the income statement, which shows each expense as a percentage of sales, is a common-size income statement.

Why Does a Common-Size Income Statement Matter?

Common-size income statements facilitate easy comparison. Not only can readers easily see how much of every dollar goes to rent, for example, they can compare that percentage to other companies or other periods in time. This allows analysts to compare companies of different sizes and not be 'blinded' by the size differences inherent in the raw data.