What Is Net Revenue?

Net revenue is defined as a company’s sales (revenue) minus discounts and returns. Net revenue is sometimes called the ‘real top line’ because it reflects total sales with only direct sales-related expenses deducted.

Profit, also called “the bottom line”, is what’s left over after all expenses – including discounts, returns, cost of goods sold, salaries, wages, and overhead and any other expenses – are accounted for in the income statement.

Net Sales vs. Net Revenue: Are They the Same?

Yes, net sales and net revenue are the same and refer to the total amount of sales of a company (minus discounts and returns).

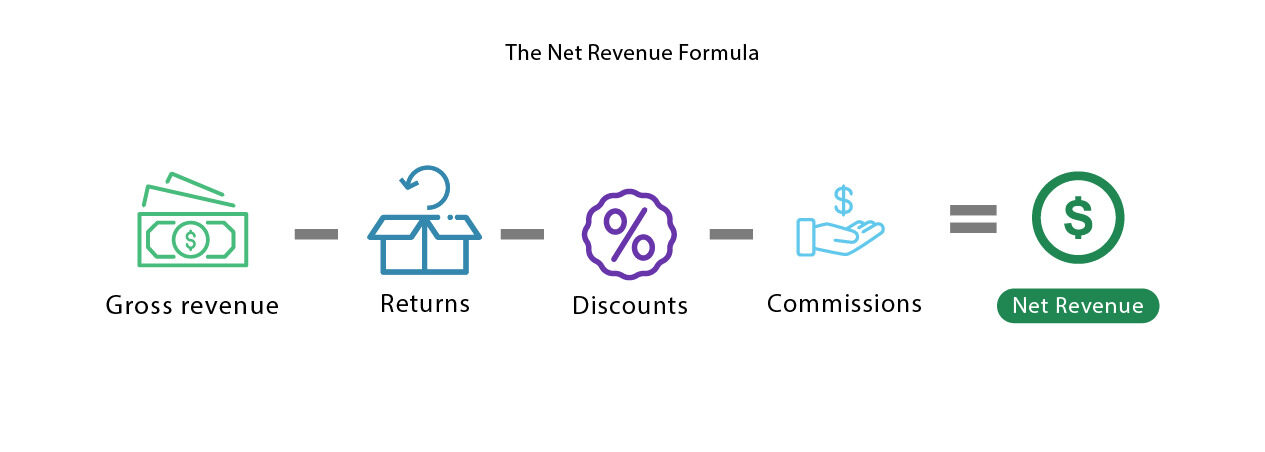

What Is the Formula for Net Revenue?

The net revenue formula is simple and straightforward:

Net Revenue vs. Net Income

Income statements begin with the total amount of money coming into a company and are reflected in gross and net revenue at the top of the statement. You’ll find net income ('what’s left over after all expenses are deducted') at the bottom of the income statement.

Net income is always found at the bottom of the balance sheet to show “what’s left over” after the bills are paid, including:

- cost of goods sold (COGS)

- SG&A (selling, general, and administrative expenses)

- depreciation and amortization

- any other expenses are deducted from the company’s net revenue.

Is Gross Revenue the Same as Net Revenue?

Net revenue accounts for any discounts, commissions, or returns. Gross revenue does not.

Assume Shop XYZ sells 100 dresses at $50 each on Wednesday. The shop reports gross sales of $5,000 for dresses on that day. If one customer returns a dress, that return must be accounted for in the net revenue (-$50). Their actual net revenue on Wednesday would be $4,950.

If Shop XYZ issues a coupon for 10% off on Wednesday only, it would also need to deduct the amount of the discount from gross revenues. Their gross revenue vs. net revenue would look like this:

Wednesday only: 10% off

Dresses: $50 each (Price)

Quantity sold: 100 (units)

Returns: 1

Gross Sales = units x price

Gross Sales = 100 x $50

Gross Sales: $5,000

Net Sales = Gross sales - returns - discounts - commissions

Returns: 1 x $50 = $50

Discounts: $50 x 0.10 = $5

Total Discounts = $5 x 99 units

Total Discounts: $495

Net Sales = $5,000 - $50 - $495

Net Sales = $4,455

Net Revenue Example

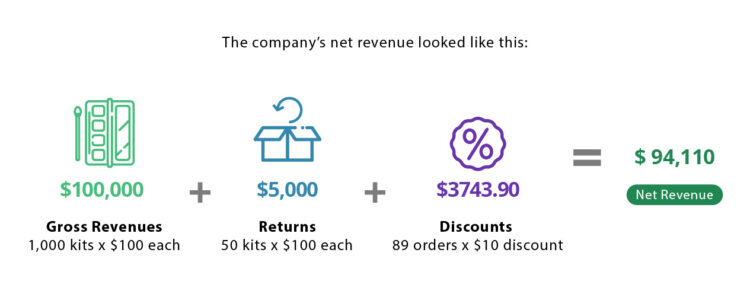

Company QRS is a direct sales company selling makeup kits by mail. In 2020, the company sold 1,000 of its $100 complete makeup kits through a direct mail catalog and television infomercial. Out of the 1,000 kits sold, 50 were returned. The company also offered a special discount through the infomercial if callers mentioned a special code. Out of the 1,000 people who ordered from either the catalog or the infomercial, 89 mentioned the code and received a $10 discount.

The company’s net revenue looked like this:

Why Does Net Revenue Matter?

Many companies (especially retailers) use net revenue as their reporting base to account for returns and discounts early on in the income statement. By doing so, they make their actual revenues clear for potential investors.

Net revenue also matters because companies that pay commissions and fees must account for these before overhead and profits (SG&A) are accounted for in the income statement. If they don’t, they can misclassify commissions as indirect expenses.

Ask the Expert About Net Revenue

Q: Can Net Revenue Be Negative?

Theoretically, yes, but it would be rare. Since net revenue is the gross revenue minus commissions, returns, and discounts, it is possible that a company could pay a higher commission and discount than the sales price of the item. To do so, however, wouldn’t make much sense, as the company would continually lose money.

Q: Net Revenue and Turnover: What's the Difference?

Turnover refers to the number of times a company earns revenue by using the assets it has. Net revenue reflects the sales of goods during the normal course of business.

Q: EBITDA and Net Revenue: Are They the Same?

No, they are not the same thing. Net revenue reflects the cost of sales while the expenses deducted from net revenue are directly related to the sales of goods. EBITDA (earnings before interest, tax, depreciation, and amortization) deducts the cost of overhead and operations from net revenue.