What is Additional Paid in Capital?

Additional paid-in capital (APIC), also called capital in excess of par value, is a measure of how much money investors have pumped into the company since inception in return for equity. The line item appears on the balance sheet.

How is Additional Paid in Capital calculated?

Let's assume that Company XYZ decides it needs to raise $10 million in equity in order to build a new factory. It does this by issuing 100,000 shares of new stock at $10 per share.

The company records the receipt of $10 million of cash on the asset side of its balance sheet after the offering is complete. It also records the additional corresponding equity on the balance sheet. However, it breaks that $10 million up into two line items: the par value of the stock and anything over the par value of the stock.

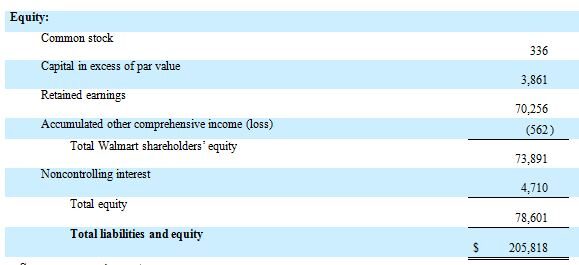

Traditionally, companies assign an arbitrary par value of $0.01 to each new share of stock. Anything over that, $9.99 in our example, is recorded as additional paid-in capital (APIC). As this snippet from a Walmart balance sheet shows, the company had almost $4 billion of APIC (dollars below are in millions).

Why does Additional Paid in Capital matter?

Additional paid-in capital reveals how much investors have poured into the company. That's not something anybody can see on the income statement or the cash flow statement, but it's important if you want to know how much shareholders have paid to play and want to ponder whether management has used that money wisely.