What are Principal-Only STRIPS?

Principal-only STRIPS are synthetic zero-coupon bonds that are based on the principal component of Treasury securities.

How Do Principal-Only STRIPS Work?

STRIPS stands for Separate Trading of Registered Interest and Principal of Securities. They are securities that represent the separate interest and principal components of Treasury securities. The U.S. Treasury created the STRIPS program in February 1985.

Though STRIPS are considered Treasury instruments, they aren’t really Treasury securities. They are synthetic zero-coupon bonds. A zero coupon bond is a corporate bond that makes no periodic interest payments, but is sold at a deep discount from face value. The buyer of the bond receives the rate of return by the gradual appreciation of the security, which is redeemed at face value on a specified maturity date.

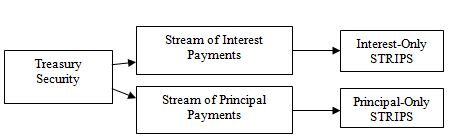

Essentially, STRIPS are created when a financial institution buys a T-Note or T-Bond and then turns each interest and principal payment into a separate security (i.e., it 'strips' the interest and principal payments). These new securities are sold as zero-coupon bonds with maturities that correspond to the timing of each particular interest payment.

For example, consider a seven-year Treasury note. The note consists of 14 interest payments and one principal payment due at maturity. A financial institution could take this security and create 15 STRIPS: one interest-only STRIP for each of the 14 interest payments and one principal-only STRIP for the principal repayment. Each STRIPS has its own CUSIP number and is sold at a deep discount; the securities then increase in value every year until they reach their face values. For example, a financial institution might sell a STRIPS representing one of the seven-year Treasury's $500 interest payments to an investor for $200. As the note's interest payment draws near, value of the corresponding STRIPS increases, ultimately reaching $500.

The U.S. Treasury does not issue zero-coupon securities with maturities beyond 26 weeks, so STRIPS fill the void. Investors cannot purchase principal-only STRIPS directly from the U.S. Treasury; rather, financial institutions create and sell them. (The U.S. Treasury does make the STRIPS program viable, however, by making the physical mechanics of detaching the interest and principal payments possible.)

Why Do Principal-Only STRIPS Matter?

Institutional investors make up most of the market for STRIPS, but individual investors can easily purchase and trade STRIPS as well by contacting a broker/dealer. Many investors hold STRIPS through mutual funds. Principal-only STRIPS can be excellent investments for investors who are especially wary of risk or need specific payments on specific future dates. They are also good for tax-deferred accounts such as IRAs. But there are factors the investor should consider before investing.

First, even though principal-only STRIPS carry little call risk or default risk, they do carry interest-rate risk, meaning that when interest rates rise, principal-only STRIPS prices fall, and vice versa. Fortunately, in periods of rising interest rates, principal-only STRIPS prices tend to fall less than other bonds do. Thus, with their virtually guaranteed repayment, principal-only STRIPS make excellent defensive plays in an uncertain market.

Second, inflation takes a bigger bite out of principal-only STRIPS returns than from riskier but higher-yielding fixed-income securities. Thus, changes in inflation expectations or the degree of uncertainty about inflation can really affect principal-only STRIPS prices.