What is a Flat Yield Curve?

Flat yield curve refers to a yield curve that reflects little or no disparity between short-term and long-term interest rates.

How Does a Flat Yield Curve Work?

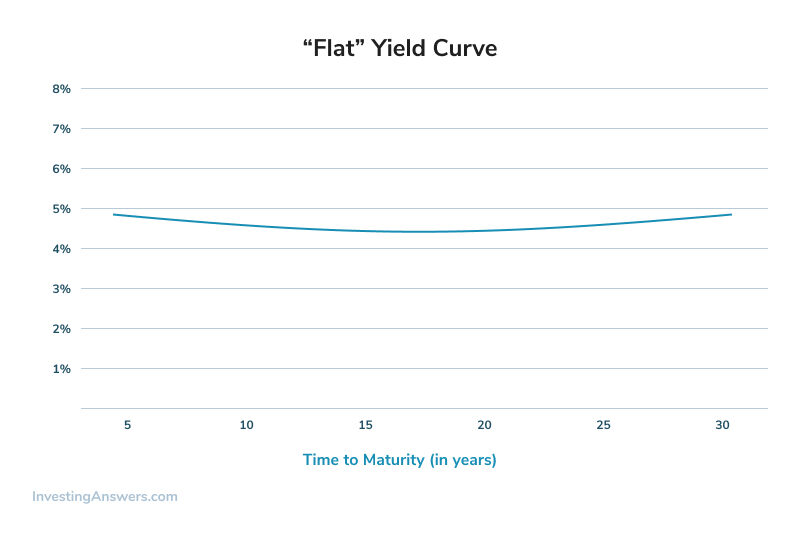

A flat yield curve is essentially a horizontal line representing similar yields for short-term and long-term debt securities in the same credit category, as shown below:

Under these circumstances, for instance, a bond with a 30-year term would have virtually the same yield as a similarly-rated bond with only a five-year term.

Why Does a Flat Yield Curve Matter?

A flat yield curve indicates that there is no immediate benefit to investing in long-term securities over short-term securities since the yield on either is essentially the same.