In my first trading lesson I defined technical analysis and swing trading.

[If you missed the first installment of my swing trading course, click here to read Start Swing Trading Today.]

I showed how technical analysis is vital to your swing trading success and illustrated the enormous profits that you can make through regular trading. I used a brief example trade on real-life but renamed XYZ Corp. (XYZ) to illustrate a series of successful swing trades that could have yielded you enormous returns in a short period of time.

In great trades, I argued, the technical tools at your disposal should all give you the same message. Candlesticks, support/resistance, MACD and the histogram, CCI, stochastics, volume analysis and trendlines all give very clear messages about a successful trade.

On the XYZ chart I drew trendlines, not only on the price chart, but also on indicators such as rate MACD, MACD and RSI.

And finally, I argued that the most important skill in technical analysis is being able to detect the trend of the time frame you are trading in.

Why the Trendline is So Powerful

.gif)

This one-hour class would typically draw an audience of 70 to 80 people per session. I would start by asking the group how many people had money in the stock market. Virtually all the hands went up. I would then ask how many people had drawn trendlines on the charts of stocks they owned within the last month. Perhaps three or four people would raise their hands. Most people, I learned, while aware of trendlines, were neither clear about how to draw them, nor did they fully understand and appreciate the importance of doing so on a regular basis.

I recently found myself in a major bookstore -- you know, one the size of a football field. And as you might expect, the investment section was substantial, consisting of literally several hundred different titles. A thorough search for those on technical analysis left me with just three or four, and out of those, only ONE gave any kind of direction as to how to draw a trendline. And even then, the directions were disappointingly vague and unclear. No wonder traders are often uncertain on how to use this most basic -- yet powerful -- tool!

Today's topic can and should help make your very next trade more profitable. If you do not know how to draw trendlines, then I suggest you print this lesson.

At the end of this report, I will present a chart and ask you to analyze it based on trends and trendlines. I will then present the 'answer' in Lesson #3: Swing Trading Support & Resistance Secrets.

Enjoy!

-------------------------------------------------------------

What is Meant By a Trend?

Before we discuss trendlines, let's consider the idea of trend. My definition of this term is a 'stock market movement sustained over a specific trading time frame.'

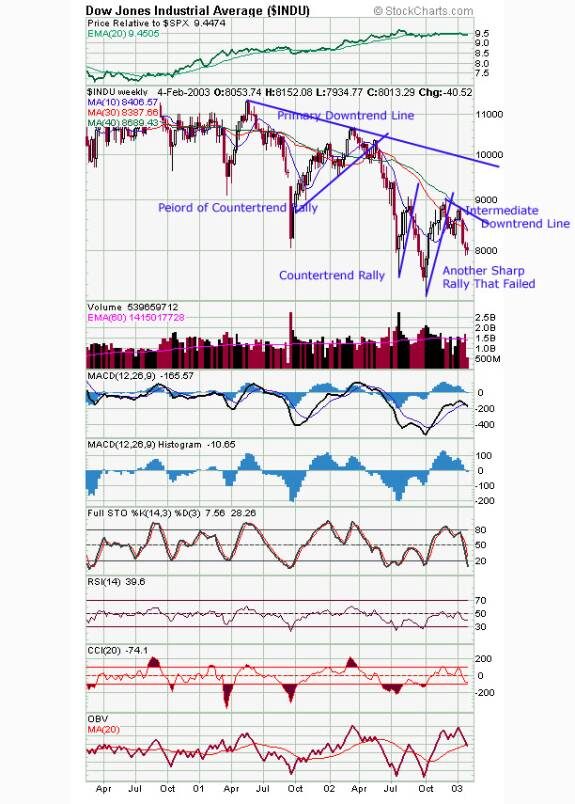

Below you'll find a historical chart of the Dow Jones Industrial Average. Although the chart is not current, it will serve as a perfect example for our discussion of trends.

A trend may be either up, down or sideways. In the chart below, you'll note that I've identified the primary trend, which generally lasts several months to several years (I have marked this 'primary downtrend line'). In this particular example, the great 1990s bull market ended in 2000. That gave way to a new primary trend -- a lengthy bear market that corrected the excesses of the previous bull.

Within this primary trend I've also identified an intermediate trend, one that lasts several weeks to several months. The intermediate trend may be in harmony with the larger trend -- in a bear market the trend of a several-week to several-month period could be down -- or it could be out of harmony, in which case we can speak of a 'countertrend' rally. Note the three countertrend rallies drawn on the chart.

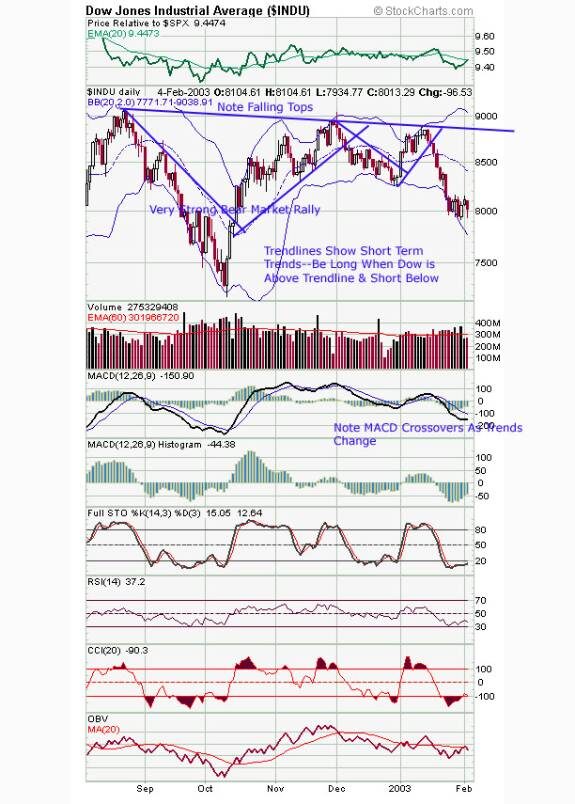

Finally, there are a variety of short-term trends. These trends may last several days to several weeks and are of extreme interest to swing traders. While primary and intermediate trends can be easily seen on the weekly chart, I've found that it is often best to magnify short-term trends by using daily, hourly, and even one-, five- or ten-minute periods. With this in mind, below I present you with a six-month daily chart of the Dow from this same time period. In it, I've noted periods of uptrend and downtrend -- periods when the swing trader should be long or short stocks that correlate highly with the Dow.

How Do You Define an Uptrend or Downtrend?

An uptrend is a series of higher highs and higher lows. When I taught seminars, I often suggested that students repeat this statement several times so it is etched into their memory. I recommend you do the same.

Many traders go long during severe downtrends: they buy stocks that have a pattern of lower highs and lower lows simply because those particular stocks look 'cheap.' Unfortunately, what is cheap often becomes a lot cheaper, and if the trader has not set a tight stop, he or she can quickly accumulate huge losses.

A very simple way to tell if a stock is an uptrend is to label the peaks and valleys with a 'P' for peak and a'V' for valley. I often use this very simple exercise as my starting point when analyzing a chart. These peaks and valleys are in fact support and resistance points for the stock, and breakouts or breakdowns from them are critical for swing traders to recognize. When labeling the peaks and valleys I try to catch important swings and ignore some of the blips. Below you'll find a seven-month daily chart of XYZ Corp. (XYZ) -- the stock discussed in Lesson #1. I've now labeled the Peaks (P) and Valleys (V) on this chart.

Note how the simple act of labeling the peaks and valleys allows you to determine and ride the prevailing uptrend or downtrend. When this pattern of peaks and valleys reverses, you, as an alert swing trader must take action.

The act of labeling peaks and valleys is helpful because it allows you to spot a trend as it continues, as well as to quickly spot reversals. Trend reversals are key for you to recognize as early as possible because they allow low-priced entry levels and/or enable you to take profits near the top or bottom of an extended move.

Another equally simple technique to catch the trend reversal is for you to draw a trendline. Unfortunately, there are few books on technical analysis that give clear directions on how to do this. In the next section of the tutorial I provide you with a step-by-step description of how to draw a trendline, again using the XYZ chart. These directions will enable you to draw a 'simple' uptrend line. My experience has taught me that about 85% of trendlines are of this variety; the other 15% are more complex and trickier to draw. In today's lesson I'll show you how to draw both.

3 Steps to Drawing a Simple Trendline

First, start with a cycle low.

In the chart below, note how the $2.20 level stands out as a clear bottom in October. This point is what I call cycle low, as a sustained price movement clearly began here. Candlesticks may help you recognize an absolute bottom, but in order to draw a trendline, you must first see a bounce off the low. In other words, the trend must have already started.

Next, find a second point that will allow you to draw a straight line.

This second point will usually occur after a pullback from the initial buying surge associated with the trend reversal. Note how XYZ's shares advanced almostvertically from $2 to more than $4 and then went sideways for several days.

If we had used the point at about $4.50 in mid-October, then the trendline would have broken almost immediately. This would have led to an incorrect trading decision. Instead, by waiting for a pullback, the next to last bar in October allowed us to find a second point that we could connect with a straight line (labeled 'point 2'). This price level was about $3.65.

Finally, find a third point on this same line.

Two points on a line allow you to draw a somewhat tentative or hypothetical trendline; when three points have been touched, the trendline is confirmed. With XYZ, this third point was touched at about $5.50 in mid-November. Once you have found this third point, extend the line 'into space.' As long as the stock's price stays above that trendline, by definition the stock is in an uptrend. You should hold the stock as long as the shares stay above the trendline or unless you see some early warning signal given by indicators or candlesticks that the trend may reverse.

Note that in early November, shortly after XYZ touches a peak of $7.55, the trendline is broken. A broken trendline means one of two things: either the stock will go into a period of sideways consolidation, or it will reverse course -- an uptrend will turn into a downtrend and vice versa. In both cases, profit-taking is appropriate. In the example below, note that the broken uptrend line was a potent signal and was confirmed by negative signals from indicators such as MACD, CCI, Stochastics and RSI. The alert swing trader would have read the tea leaves and would have sold at or above $7.

The rules for drawing downtrend lines are exactly the reverse as those for drawing the uptrend line. Instead of a cycle low, we start with a cycle high. Note that while the uptrend line is drawn under the valleys of the shares, the downtrend line is drawn above the peaks formed by the stock.

Between mid-November and mid-January, XYZ sold off and then recovered, slightly bettering its previous high. This mid-January peak could then be recognized as a new cycle high and a downtrend started from there. Again, I look for 'point 2' and 'point 3,' both of which I have labeled in the chart above.

Note that the trendline drawn from the mid-January high was still in force as of the last day of this chart. From a technical analysis perspective one should not be hunting for a bargain in XYZ from the time of the mid-January high until the end of the chart in early February. Rather, an efficient swing trader should either be on the sidelines or short this stock. Given that this particular stock 'trades' several hundred thousand shares each and every day, a large number of traders obviously violate this simple rule day in and day out! You now know better.

Following a stock closely and playing it from both the short and long sides based on changes in trend can be a very profitable activity. It is a method I've used with tremendous success in my personal trading, and it is a strategy I share with subscribers in each of my weekly newsletters.

A Few More Words on Simple Trendlines...

Here are a few more key points about trendlines. First, insofar as possible, a trendline should not pass through the price bars of the stock. Sometimes it is absolutely necessary to violate this principle to get a straight line, but in about 95% of cases you should follow this principle.

Next, I find trendlines of about 45 degrees in slope can hold for long periods when placed on arithmetic charts (the XYZ chart is arithmetic -- equal space is given to each dollar increment change in price). By contrast, trendlines with slopes much steeper than 45 degrees are apt to break quickly (as did XYZ in early October). Not being aware of this principle can lead to premature exits from profitable positions or disastrous trades counter to the trend.

A third important point is that you can sometimes find more than one valid trendline on a given chart. For example, a stock can have a basic uptrend and then accelerate sharply upward. If we return to the weekly Dow Jones Industrials chart we looked at a few moments ago, you will see I have labeled both a primary trendline and an intermediate trendline on the same chart.

.jpg)

How can this be possible?

Well, a trendline can be drawn both to capture the basic trend and also to mark a sharp acceleration in trend (whether up or down).

An intermediate-term trader might be content to use the basic trendline as an exit point. A swing trader, however, would pay great heed to the accelerated trendline to avoid giving back any profits unnecessarily.

Finally, the more times a trendline has been touched, the more significant it becomes. A trendline in force for, say, a year -- when it does get broken -- shows a very important shift in the supply/demand of the stock and provides you with an important opportunity to take profits or establish new positions.

How to Draw a Complex Trendline

As I mentioned before, 85% of trendlines are of the 'basic' variety, which I have described above. However, the other 15% of the time, you may need to draw much more complex trendlines.

For example, there are times when a stock posts an almost vertical rise off a bottom and then begins to trend. In these cases, you cannot fashion a simple uptrend using a straight line. Although you can still follow the principles I outlined above, you'll occasionally need to begin somewhat off the cycle low. I've illustrated an example of this type of trendline in the real but renamed BrandEx Co. (BEX) chart below.

Other Trend-Following Tools

Over time, technical analysts have developed many, many tools for keeping on the right side of the trend. For example, moving average and moving average crossover systems function much like trendlines by spotting early changes in trend in the trader's timeframe. MACD also functions primarily as a trend-following indicator.

The rule of 'multiple indicators' says that the more tools that give the swing trader the same message, the more likely it is that his/her interpretation of the chart is correct and that this chart will lead to a profitable trade. For me, putting together multiple tools and synthesizing their message is what technical analysis and profitable trading are all about.

Where Do We Go From Here?

In today's trading lesson I have demonstrated how to use two important tools of technical analysis -- the labeling of peaks and valleys and the drawing of trendlines. Both of these techniques should help you greatly improve your swing trading performance, but there is still much more to learn!

With this in mind, in my next lesson I will show you how to profitably use support and resistance. Identifying support and resistance levels is vital to understanding whether a trend will continue.

In addition, I will share a concept with you that I have yet to see addressed in any technical analysis book -- the difference between 'simple' and 'significant' support and resistance. I'll also introduce you tomany profitable trading strategies based on support and resistance that you can use in your own trading.

And finally, I'll show you how support and resistance, when combined with trendlines, creates many of the patterns of classical technical analysis, such as ascending and descending triangles. If you can learn to properly recognize these formations, then this knowledge will assist you in anticipating what a stock will do next.

Correctly anticipate and watch your brokerage balance grow! I invite you to join me for my next lesson as I explore 'A Big-Swing Trader's Support and Resistance Secrets.'

But before I go, I'd like to present you with a daily chart of the real but renamed Trendco Inc. (TREN). If you're interested in testing and honing your analytical skills, then I'd encourage you to print this chart and draw trendlines on it. Historical trendlines are important for study, but you'll always find the most important trendlines at the right-hand edge of the chart. As such, I'd like you to focus on the December-February period. What does this trendline tell you about the stock as of early February?

Should you be long, short, or just watching? In my next trading lesson I will draw trendlines on the chart below and will allow you to compare your interpretation to mine.

Click Here For the Next Installment In Dr. Pasternak's Swing Trading Course: Swing Trading Support & Resistance Secrets.