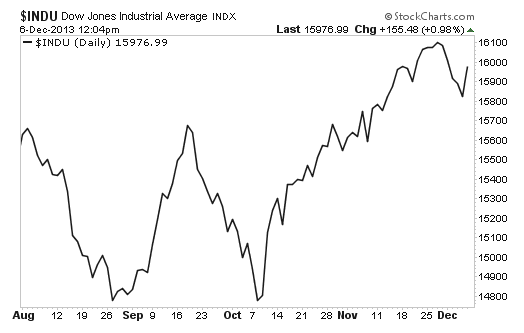

The recent stock market pullback has sparked a bearish fever in many traders.

All the major indices have slipped lower, prompting the bears to start their dance of doom. While in my view, the selling is clearly nothing but short-term profit taking and not a signal of anything ominous, it doesn't prevent the bearish fearmongers from dominating the financial media with nebulous terms like 'overextended' and 'overvalued.'

I love it when the stock market bears crawl out of their caves. The louder they get about an imminent market crash, the more confident I become that it's not going to happen anytime soon.

These bears cite the risk of recession, the end of the Federal Reserve's quantitative easing measures, weak corporate earnings and even China's slowdown as the potential catalysts that will send stocks into the next bear market. The funny thing is, the more bears there are, the lower the likelihood of a crash or sharp correction taking place. The opposite also holds true.

When everyone is super bullish, that's when it's time to expect a market correction. Even the bears have a name for this phenomenon: climbing the 'wall of worry.' Stocks are said to be climbing the wall of worry when they are acting the opposite of what the bears expect. Certainly, there will be pullbacks and even a few sharp drops in every bull market, but I expect the long-term upward trend will remain in full effect well into 2014.

Here are three price drivers I see powering the bull market next year:

1. Cash Inflows

The stock market is controlled by buying and selling. These so-called inflows and outflows of capital are what determine stock prices. Investors transferred $12 billion into stock funds in just the final week of November, according to Lipper, the largest increase in five weeks. Funds specializing in U.S. stocks attracted $8.9 billion of these inflows, while non-U.S. stock funds absorbed $3.1 billion.

Research firm Strategic Insight is projecting net inflows of $450 billion for 2013 for equity mutual funds and exchange-traded funds (ETFs). This is more than the previous four years combined.

Low rates are forcing more money into stocks as investors embrace risk in pursuit of greater returns. As the stock market pushes higher, it attracts more and more money since a higher stock market increases investor confidence.

There's a common saying in financial circles that liquidity begets liquidity. This is the same dynamic at work with the stock market pushing ever higher.

2. The Federal Reserve

Think of the Federal Reserve as the wizard behind the curtain. The world's most powerful central bank sets the economic tone by tightening or loosening monetary policy. Its powers include its command of interest rates and an entire host of quantitative tools to spark or slow economic activity. The Fed is showing zero sign of ending its QE program anytime soon and has said its decision to start tapering depends strictly on the economic data. The Fed's last statement reiterated the fact that the overall housing sector has actually slowed somewhat and an average of only 185,000 new jobs have been added over the past 12 months. With interest rates near zero, and the Feds unlikely to start tapering until well into 2014, the stock market has no place to go but higher.?

3. Stronger Corporate Earnings

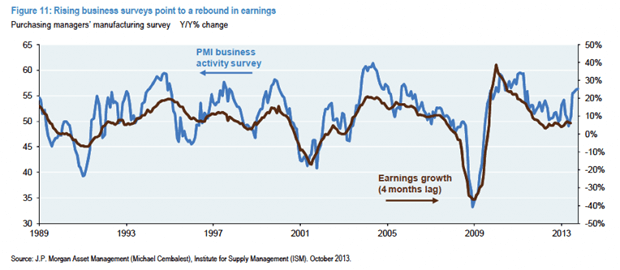

I am a huge proponent of using forward-looking indicators when making economic projections. Investors are often guilty of hindsight bias when they're thinking about what's about to happen. Pure technical analysts and price action-type traders are the guiltiest when it comes to this investing sin. While forward-looking indicators contain their own faults, I have found value in using several of them. Business Insider recently reported that J.P. Morgan compared corporate earnings growth against global purchasing managers' index (PMI) readings. Earnings growth on the chart lags behind PMI by four months.

As you can see, the recent upward move in PMI is indicative of earnings growth soon to follow. This is signaling that we should soon experience an overall improvement in earnings in the first quarter of 2014.

Risks to Consider: Anything can and does happen in the stock market. So-called black swan events can strike at any time, knocking stocks lower regardless of what is projected. No matter how bullish you think the future is going to be, always be sure to use stop-loss orders and diversify.

Action to Take --> Sticking to your investment plan regardless of the bearish chatter is the key to investment success. Work on tempering your emotions when making investing decisions.