Is your January credit card statement staring you in the face, and looking eerily similar to your December one? You know that unpaid holiday shopping, and everything else you're putting on your plastic in the mean time, is costing you.

But did you know that even if you pay your bill in full every month, you'll probably spend more on a credit card than if you would have paid in cash or on a debit card?

[InvestingAnswers Feature: 'Credit or Debit? Your Choice Could Cost You 3%']

The Journal of Consumer Research completed a study that shows paying with a credit card increases a consumer's propensity to spend compared to using cash.

Similarly, Javelin Strategy and Research took a look at Cyber Monday spending habits and found that the average credit card purchase was $82.10, whereas the average debit card purchase was only $58.29. And those debit card purchases wouldn't still be haunting you today.

Overspending isn't the only hazard of credit card usage. Let’s face it, not everyone pays off credit cards in full every month. The common rationale is that credit card rewards make them more desirable than other methods of payment.

However, couple overspending with the cost of interest payments and the meager rewards of many credit cards pale in comparison.

In May 2011, Americans held $793.1 billion in credit card debt. If you divide that number by the number of Americans with credit cards (50.2 million) it means the average American has an astounding $15,799 in credit card debt.

The number keeps on growing, because even with legislation aimed at protecting consumers from credit card debt, the system is stacked against consumers.

Credit Card Debt's Downward Spiral

For example, let's say you have $5,000 in credit card debt. Your minimum payment, typically between 2% and 5% of the total balance, which if we assume it is 4%, would be $200. Of that $200, $62 is going to interest and only $138 is actually going toward the $5,000 in debt.

Here's how you can calculate this amount:

APR typically runs between 12% and 17%. Let’s assume for the example, the APR is 15%.

1. Divide the APR by the days in a year: 15% / 365 = .041%

2. Multiply .041% by the average days in a month, 30 = 1.36 or .0136%

3. Then, multiply .0136% by the original balance, $5,000 to find the total amount spent on interest per month = $62

If you pay minimum payments in this scenario, it would take 105 months to pay off $5,000. That is almost nine years!

Over that time, you would pay $2,118 in interest, and these numbers assume that you never purchase anything else with that credit card.

This means the original $5,000 balance will cost you $7,118 -- so much for those Black Friday and Cyber Monday so-called deals.

Any money that you might have saved on a great sale likely went out the window after the $62 in interest you spent in the first month.

A Better Way to Look at How Much Your Credit Card Is Really Costing You

Obviously, paying off a credit card in full every month is the ideal situation, but to get a true grip on the opportunity cost, it is important to see how much could be earned if the money paid in credit card interest was invested instead in, say, a corporate bond.

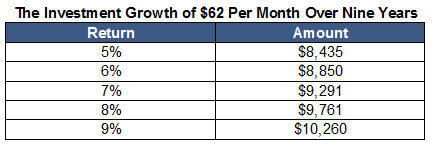

If you were to take the $62 a month that would go towards interest on your credit card, and invest it into a corporate bond fund with a 4% return, your investment could have grown to $8,044 over nine years. If the investment's return was higher, you could have earned even more...

Investing $62 per month over nine years, your money could grow to:

Even at a modest 2% return, $62 a month could grow to $7,330 over nine years.

[Want to try your own savings calculations? Try our Simple Savings Calculator]

What you're seeing is the power of compound interest. Keeping a balance on your credit card only holds you back from taking advantage of it.

Let's go back to our original example. By choosing to pay the minimum credit card payment over nine years instead of paying off your credit card fast, you're racking up $2,118 in interest charges. And because the interest charges you paid every month could have gone toward investing toward your future, you've lost out on potentially $10,000 more.

All said, simply paying the minimum in this case is a $12,118 mistake. Now are you convinced that you should be more serious about paying off your credit card and investing your money?

The Investing Answer: When you pay interest on credit cards rather than making interest on investments, the power of compound interest works against you, resulting in increased debt.

By paying credit cards in full and investing a little every month, you can end up making money and avoid crippling debt.

If you're having trouble paying off your credit cards, check out this InvestingAnswers feature, '10 Ways to Dig Yourself Out of Credit Card Debt.'

Once your debt is paid off, you can try a different option: 'Prepaid Debit Cards: The Best Alternative to Traditional Banking.'